CGA’s research has shown how Ireland’s capital has been hit particularly hard by the pandemic. While recent drinks sales volumes across the country reached 81% of the level seen in the same month in 2019, in Dublin the figure was notably lower at 66%. With both tourists and office workers slow to return, and anxiety about the new COVID-19 variant increasing, it may be some time before sales consistently match pre-pandemic levels.

However, CGA’s exclusive new OPUS of more than 2,500 consumers reveals encouraging potential for growth. Key segments include spirits, where volumes reached 88% of 2019 levels in September—three percentage points higher than Ireland’s average. This has been driven by the surging interest in cocktails identified by CGA’s new Mixed Drinks Report for Ireland, and a third (32%) of Dubliners now drink these out-of-home, five percentage points above Ireland’s average.

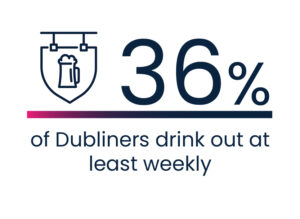

The OPUS survey confirms how Dublin residents are heavily engaged with the On Premise, with more than a third (36%) drinking out at least weekly. The city is also a magnet for consumers elsewhere in Ireland, as nearly two in five (38%) go there to eat or drink regularly.

When they head out in the city, consumers are open to trying new things. They over-index on both the likelihood of trying a venue based on recommendations and drinks promotions. Other important channels for drinks sales in the capital include restaurants, which make up a much higher proportion of licensed premises than they do elsewhere in Ireland.

“Dublin should be a key focus of the recovery strategies of all drinks brands,” says Phil Montgomery, CGA’s Director of Client Services UK & Ireland. “But with footfall slow to recover and confidence still fragile, suppliers are going to have to work hard for growth in 2022. It’s going to be crucial to understand the significant differences in habits and preferences in the city compared to other parts of Ireland, and to work out how to position both established and new brands correctly.”

The November edition of CGA’s OPUS survey provides a rich resource of data and insights that reveal how consumers are engaging with restaurants, pubs and bars. It helps suppliers and operators answer category, channel, occasion and brand questions and optimise sales and marketing strategies across Ireland and Northern Ireland. To learn more, email Phil Montgomery at phillip.montgomery@cgastrategy.com.