It shows that British food is eaten in restaurants by 80% of consumers—making it the champion cuisine ahead of Italian (70%), Chinese (68%), Indian (64%) and American (60%). Beyond this dominant big five come Mexican (46%), Spanish (43%) and Thai (42%).

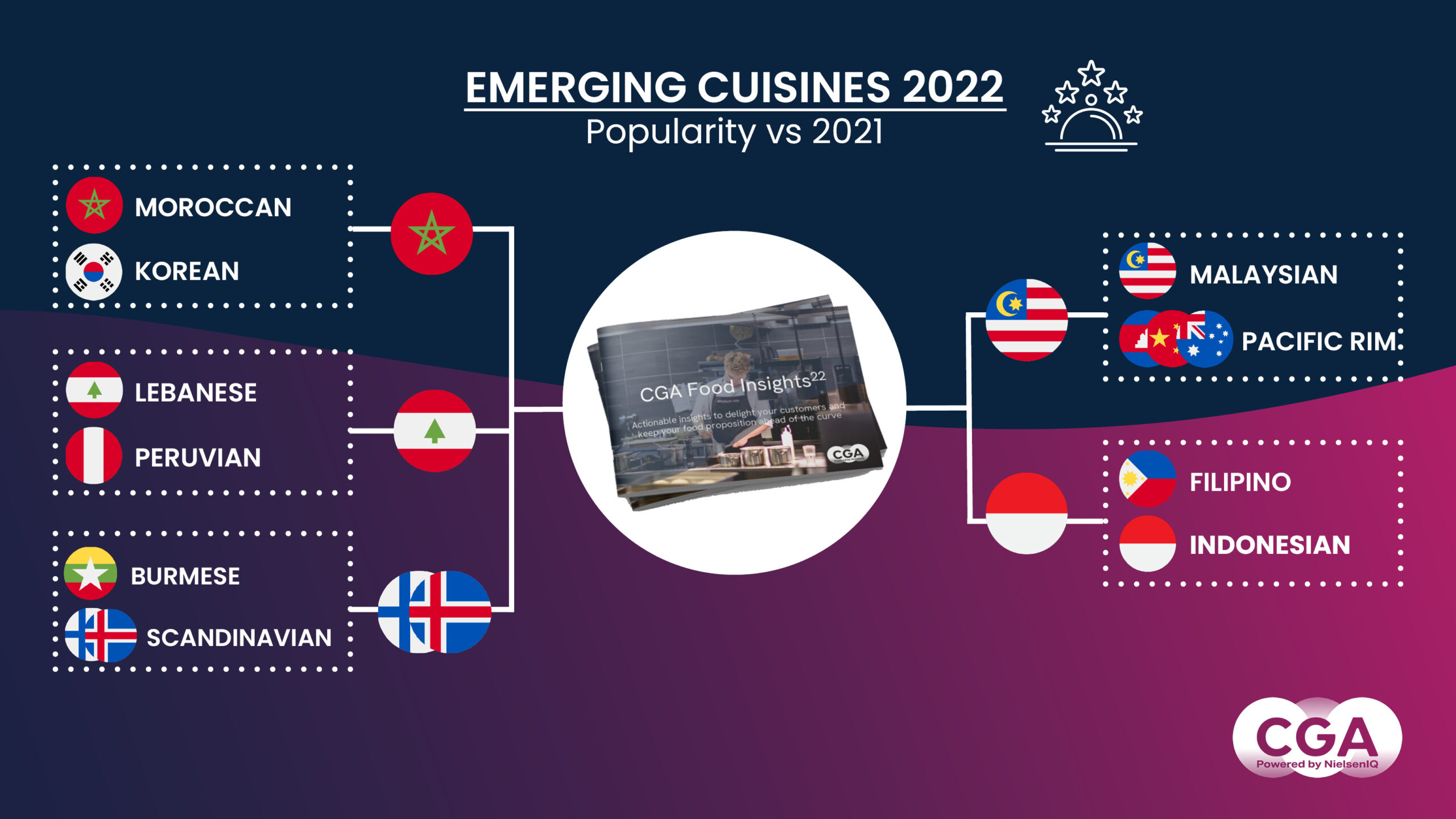

‘Food Insights 2022’ also sets out Britain’s top emerging cuisines—defined as food that more people would like to eat than already do so, and that is harder to find in towns and cities than established cuisines. Topping this group are Burmese, Peruvian and Filipino cuisines, ahead of Scandinavian and Pacific Rim food. Other countries moving up the ranks of emerging cuisines in the last 12 months include Indonesia, Malaysia and Morocco.

CGA’s research highlights consumers’ difficulty in finding restaurants that serve these types of food. Well over half of consumers think Burmese (58%), Peruvian (57%), Filipino (57%) and Scandinavian (57%) cuisines are all difficult to find—which creates opportunities for operators, suppliers and investors to fill the gap.

“Many parts of the eating-out sector are now saturated, but there is plenty of space for entrepreneurial operators and their supply partners to break through with the right offers,” says CGA client director James Ashurst. “Consumers remain hungry for new experiences and flavours in restaurants, and despite the pressure on their spending at the moment there will always be room for distinctive, high quality and good value concepts to thrive.”

CGA’s ‘Food Insights Report 2022’ offers much more analysis of established and emerging cuisines, helping suppliers, wholesales and operators understand consumers’ latest preferences and respond with winning sales, marketing and brand strategies.

As well as global cuisines, the report features actionable insights on food trends and hot topics like mindful dining and calorie counts on menus—plus the latest intelligence from CGA’s market measurement and consumer research sources.

The full ‘Food Insights Report 2022’ is available now. Download more information about the report here, or please contact James Ashurst at james.ashurst@cgastrategy.com.

“Many parts of the eating-out sector are now saturated, but there is plenty of space for entrepreneurial operators and their supply partners to break through with the right offers,” says CGA client director James Ashurst. “Consumers remain hungry for new experiences and flavours in restaurants, and despite the pressure on their spending at the moment there will always be room for distinctive, high quality and good value concepts to thrive.”

“Many parts of the eating-out sector are now saturated, but there is plenty of space for entrepreneurial operators and their supply partners to break through with the right offers,” says CGA client director James Ashurst. “Consumers remain hungry for new experiences and flavours in restaurants, and despite the pressure on their spending at the moment there will always be room for distinctive, high quality and good value concepts to thrive.”