Previous On Premise User Survey (OPUS) research from CGA revealed the changing nature of consumer behaviors, needs and motivations since returning to the On Premise following restrictions and lockdowns over the past two years. This highlighted the need for suppliers and operators to better understand these changes and how they can best leverage their strategies to engage target consumers who are returning to visit bars and restaurants.

CGA’s OPUS is a nationally representative survey of On Premise users, designed to help suppliers understand where and how to reach target consumers. The research provides size of the prize opportunities for drinks categories and brands by occasion and channel.

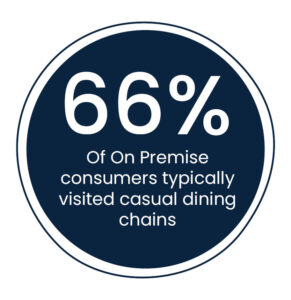

The data revealed that before COVID-19, 66% of On Premise users typically visited casual dining chains, and 83% of these consumers visited at least monthly; demonstrating a channel with high engagement and multiple opportunities for drinks suppliers to succeed. However, COVID-19 has had a significant impact on consumer visitation, so how can suppliers and distributors effectively inform their conversations with beverage directors if they have limited knowledge surrounding changing consumer behavior?

monthly; demonstrating a channel with high engagement and multiple opportunities for drinks suppliers to succeed. However, COVID-19 has had a significant impact on consumer visitation, so how can suppliers and distributors effectively inform their conversations with beverage directors if they have limited knowledge surrounding changing consumer behavior?

Being able to truly understand the nuances of consumer preferences, need states and motivations to influence effective decision-making is key to success. CGA’s research highlights that On Premise occasions are now more important to consumers, and operators need to be able to cater to new needs and expectations during visits. In addition, the knowledge around consumers’ choice on quality, taste, service and experience is also paramount to exceed customers’ expectations. Collaborating with this granular level of consumer research presents an opportunity for suppliers and operators to maximize On Premise strategies.

Further to this, the data revealed that 56% of consumers in-venue would opt for recommendations made by the bartender. This emphasizes the importance of bartender advocacy programs within venues; having trained and knowledgeable service staff is invaluable as they identify opportunities for trade-ups and drink choice. Where some venues now may find themselves with a reduced workforce to support in this final step of the sale, other paths to purchase must be optimized.

The most popular alcoholic categories consumers are ordering in casual dining chains is led by beer (37%), followed by cocktails (27%) and wine (27%). As a result, casual dining chains should be a key target for all categories due to the many opportunities to influence a sale of the category and brands within the channel.

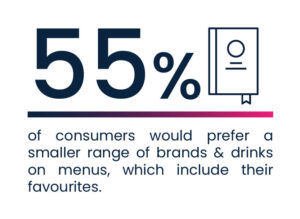

Optimizing drink menus plays a key part in influencing consumer drink choice. 55% of consumers would prefer a smaller range of brands and drinks on menus, which include their favorites, versus 45% who would prefer a wider range of choice. Menus must appeal to target consumers and where operators have implemented a reduced menu, suppliers must showcase the value of their brands to beverage directors and understand their needs when creating strategies to attract consumers.

Optimizing drink menus plays a key part in influencing consumer drink choice. 55% of consumers would prefer a smaller range of brands and drinks on menus, which include their favorites, versus 45% who would prefer a wider range of choice. Menus must appeal to target consumers and where operators have implemented a reduced menu, suppliers must showcase the value of their brands to beverage directors and understand their needs when creating strategies to attract consumers.

Previously, the use of Off Premise or measurement data alone was seen as enough to facilitate partnerships between suppliers and operators. Coupled with limited data on targeting consumer demographics, this research provided limited insight for targeted activities to influence or grow value and share. Recent CGA consumer pulse data has shown that 45% of consumers say their drink preference changes when visiting bars and restaurants versus having drinks at home. This demonstrates that visitors fundamentally ‘shop’ differently than Off Premise consumers. Having access to On Premise consumer data and insights significantly improves the prospects of effectively targeting and influencing purchase when consumers visit bars and restaurants.

Matthew Crompton, CGA’s Client Solutions Director, said “COVID-19 has been a catalyst for rapidly increasing the need for a comprehensive understanding of how consumers behave in the On Premise as a minimum requirement. Every consumer visit is special and demands a unique value proposition that suppliers and operators must demonstrate when they visit, and CGA’s OPUS research can help deliver on this proposition.”

CGA’s OPUS research reveals many more important and actionable insights into consumers’ behavior in America’s On Premise. Combined with BeverageTrak sales measurement tools, the data builds a detailed picture of when, where and why consumers drink out, what they choose and how suppliers and operators can generate brand trial and loyalty. To learn more about CGA’s OPUS research and bespoke analysis, please contact Matthew Crompton at Matthew.Crompton@cgastrategy.com