Post-pandemic, under economic pressures, as consumers shift between at-home and out-of-home drinking occasions, brands, venues, and retailers must work together to meet evolving expectations for value, quality, consistency, and experience.

Cocktail Culture: Driving Cross-Channel Momentum

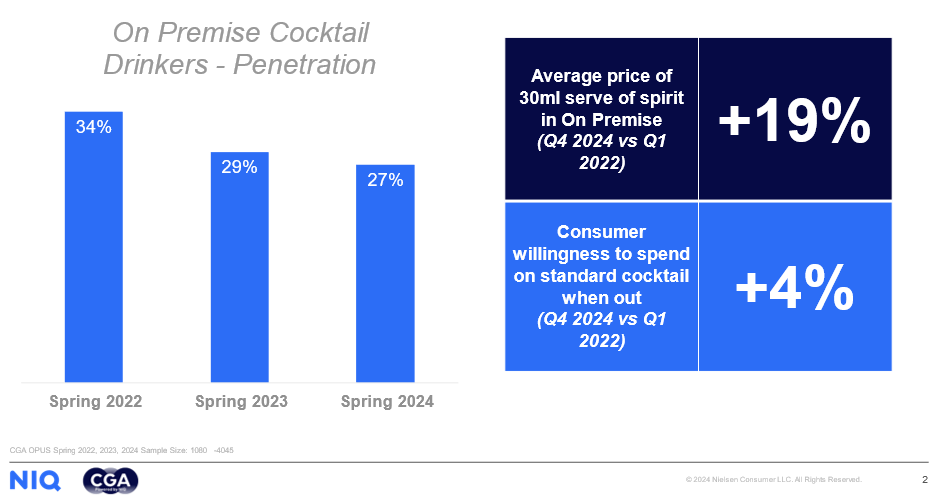

Cocktail trends are the perfect example of the interaction between On-Premise and retail. During the pandemic, consumers turned to retail for premium spirits, cocktail ingredients, and pre-mixed options to try and recreate bar-quality cocktails. Post-reopening, Bars capitalised on this renewed interest, with cocktail penetration peaking at 34% in September 2022 before declining to 27% by late 2024.

Rising costs in On-Premise have created headwinds for the category. The price paid for a 30ml serve of spirits has risen 19% since 2022, while consumers’ willingness to pay for a cocktail has only risen by 4%, affecting perceived value. To address this, venues and brands are innovating with cost-effective solutions like pre-batched and draught cocktails.

Retail benefits as these innovations also translate into accessible at-home options. With awareness of On-Premise pre-batched cocktails rising from 39% in March 2024 to 45% in October 2024, and conversion rates increasing from 51% to 56% (those aware of them going on to order them). It suggests a greater acceptance of the quality and experience provided by batched solutions – spelling potential for retail stores to talk up their own pre-mixed/batched offerings.

Light RTDs: From Retail Hero to On-Premise Staple

RTDs have grown from a revitalised retail success story to critical On-Premise drivers. Light RTDs, have reshaped the category in both channels. More recently brands have prioritised On Premise innovation, leading to On-Premise RTD penetration climbing from 48% in March 2024 to 55% in October 2024. Draught RTDs, where light expressions have grown in availability, offer unique advantages for bars, while also reinforcing loyalty and brand salience for retail store sales.

For brands and venues, Draught RTDs present an opportunity to:

- Drive experimentation: RTDs on draught can introduce beer drinkers to spirit-based beverages in a more familiar format.

- Enhance accessibility: Draught RTDs appeal to non-beer drinkers, broadening the draught line audience and facilitating inclusivity in venues, and opening the draught drinking ritual to new consumers.

- Bridge experiences: A consumer who tries a draught RTD in a bar is likely to purchase it in retail for at-home occasions, creating a seamless connection.

Brands that expand their presence across both channels will maximise RTD growth potential while fostering loyalty.

Navigating Economic Pressures Together

Economic challenges are reshaping consumer priorities. 1 in 2 On-Premise visitors report being significantly affected by rising costs, leading to more selective outings, prioritising meaningful experiences and foregoing later night drink-led antics. Retail and On-Premise can work together to meet consumers where they are, encouraging complementary behaviours:

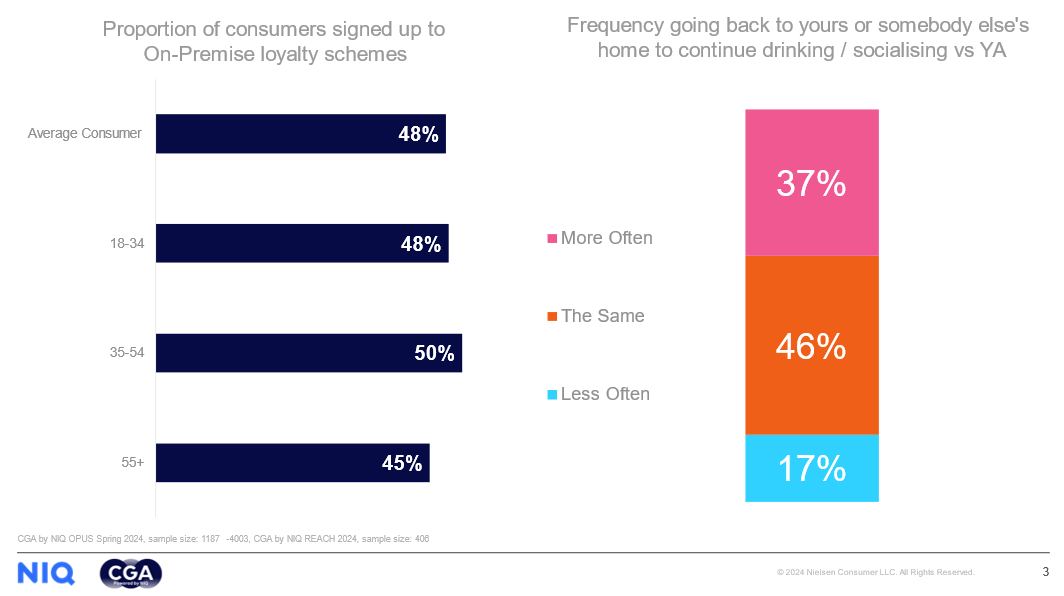

- Pre- and post-drinks: Consumers increasingly pair nights out with after visit at-home drinking/socialising (24% of consumers doing so on most of their visits – 37% of whom are increasing their frequency vs 2023, compared to only15% decreasing). Brands and retailers can promote products tailored to these occasions.

- Value messaging/Loyalty: Loyalty schemes are becoming an increasingly integral part of both retail liquor shopping and On-Premise venue visitation. Smart retailers may find ways to directly collaborate with On-Premise venues to integrate loyalty points and drive greater omni-channel value for consumers – driving greater loyalty for both businesses.

Conclusion: A Full-View of Trends

The chemistry between On-Premise venues, retail stores, and drink brands drives the liquor industry forward. By recognising how consumer behaviours overlap across these spaces, brands, venues, and retailers can better align their strategies. For each player, the approach is simple:

Retail Stores: Understand the trends in On-Premise venues and shape your offerings, marketing, and activities to maximise the impact these trends have on your sales.

On-Premise Venues: Recognise that trends also start in retail stores. Categories like RTDs and no/low alcohol options for example are driving consumer demand for a greater range in On Premise settings.

Drink Brands: Develop an omni-channel strategy that reflects the role your brand or category plays in each channel. Ensure that brand innovation or activity in one channel can enhance brand engagement in the other.

By working together, retailers, On-Premise venues, and drink brands can create an integrated strategy that meets evolving consumer needs and drives industry growth.

NIQ’s On and Off Premise insights will allow you to stay ahead of shifting consumer trends, and discover how brands, venues and retailers can collaborate to thrive in a dynamic market.

To understand how you can create seamless experiences across On-Premise and retail channels, get in touch with Tom Graham, Senior Manager at CGA by NIQ here.

Originally published in Drinks Trade Magazine