The past year has seen many nuanced shifts in the way American consumers are parting with their dollars in bars, restaurants, and other venues. CGA by NIQ takes an in-depth look at consumer visitation patterns and spending dynamics equipping industry stakeholders with crucial insights into the current consumer behaviors, economic challenges, and changing priorities shaping the On Premise industry across the nation.

Matthew Crompton, CGA by NIQ’s VP On Premise – Americas, said: “The On Premise has a very special place in American life, and it should be at the core of every beverage alcohol strategy. But in a complex, ultra-competitive and fragmented market, where preferences change fast, it’s more important than ever to get a 360-degree view of what consumers want. Our solutions can help piece together that picture and craft the insights that will be needed to craft compelling sales stories, identify opportunities and drive stocking, sales and share in the months ahead.”

Bars and restaurants are embedded in the social fabric of the US, providing unique and memorable experiences. For brands, bars and restaurants play a crucial role in reaching people and capturing market share.

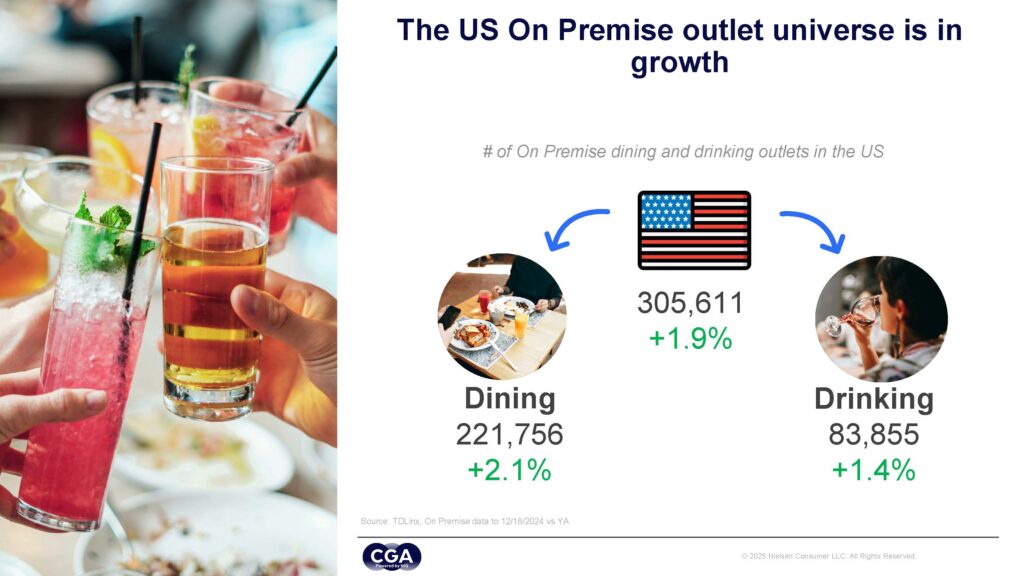

In 2024 the On Premise universe grew by +1.9% year-on-year, opening new distribution opportunities for beverage brands.

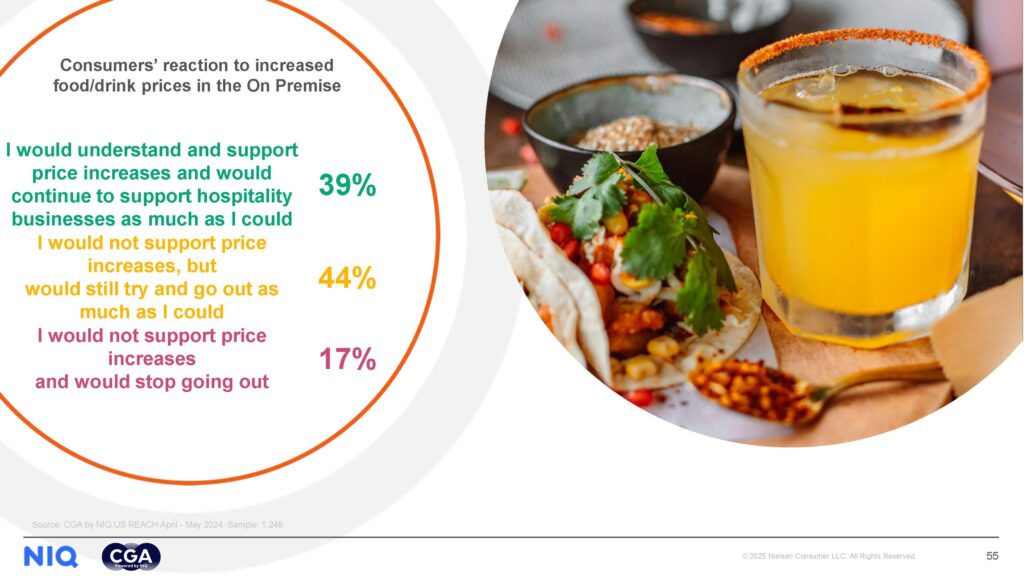

Consumers are certainly aware of rising prices. With many consumers concerned about rising costs and the economic outlook, perceptions of value are going to be important for all businesses in the US over the rest of 2025.

The United States’ dynamic On Premise is full of opportunities for beverage suppliers—and CGA by NIQ’s new research services reveals how best to capitalize on them. Click here to download The US On Premise: BevAl State of the Nation.