![]() The December edition of the Tracker reveals that groups recorded a 127% increase in sales by value from the levels of December 2019. It is a sharp rise on the 2021-on-2019 comparison of 97% in November, reflecting consumers’ decisions to stay at home and restrictions in the hospitality sector as the Omicron variant spread.

The December edition of the Tracker reveals that groups recorded a 127% increase in sales by value from the levels of December 2019. It is a sharp rise on the 2021-on-2019 comparison of 97% in November, reflecting consumers’ decisions to stay at home and restrictions in the hospitality sector as the Omicron variant spread.

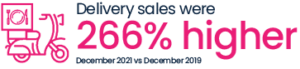

The Tracker from CGA and Slerp shows December’s delivery sales were 266% higher than in 2019—more than five times the growth of 47% in takeaways. It continues consumers’ steady move away from picking up food to having it brought to their door, and delivery volumes now outstrip takeaways and click and collect orders by some distance.

By contrast, the eat-in sales of restaurants and pubs were badly affected in December by COVID-19 concerns. The latest edition of the separate CGA Coffer Business Tracker—which has a different cohort of contributing companies—indicates a 11% drop in sales for leading managed groups compared to December 2019.

By contrast, the eat-in sales of restaurants and pubs were badly affected in December by COVID-19 concerns. The latest edition of the separate CGA Coffer Business Tracker—which has a different cohort of contributing companies—indicates a 11% drop in sales for leading managed groups compared to December 2019.

Karl Chessell, CGA’s business unit director – hospitality operators and food, EMEA, said: “Deliveries and takeaways have been a lifeline for restaurant and pub groups throughout the pandemic, and December’s sales provided another critical boost as eat-in trade dropped away. While the rate of growth may slow as 2022 goes on and COVID-19 restrictions ease, it is clear that the rapid rise of third party ordering platforms has helped to cement deliveries in consumers’ habits. Mastering this market without compromising in-restaurant sales is going to be a major priority for all operators in 2022.”

Leanne Patterson, Head of Marketing at Slerp said: “Consumers are now accustomed to the ease and convenience of delivery, and it’s very unlikely that delivery demand will drop. As we head towards key calendar dates such as Lunar New Year, Valentine’s Day and Mother’s Day, there is a huge opportunity for operators to capitalise on this demand. By creating and marketing their seasonal offerings, savvy operators can use delivery, particularly pre-orders, to fuel sales growth, alongside their On Premise offering.”

About Slerp:

Slerp is the leading online ordering solution and digital growth platform for the hospitality industry. Built for operators by operators, Slerp empowers hospitality businesses to take ownership online, shaping the future of hospitality with digital innovation.

Trusted by renowned operators, from restaurants to hotels and bakeries, Slerp offers a tailored solution that lets businesses sell direct from their websites and social channels to everyone, everywhere.

With online ordering, order at table, loyalty apps and digital marketing services, Slerp has all the solutions to diversify revenue streams and future-proof growth online.

To learn more, visit www.slerp.com

The CGA & Slerp Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, BrewDog, Burger King UK, Byron, Cote Restaurants, Dishoom, Gaucho Grill, Giggling Squid, Honest Burgers, Nando’s Restaurants, PizzaExpress, Pizza Hut UK, Prezzo, Rosa’s Thai, TGI Fridays UK, The Restaurant Group, Tortilla, Wagamama and YO! Sushi. Anyone interested in joining the Tracker should contact Karen Bantoft at karen.bantoft@cgastrategy.com.