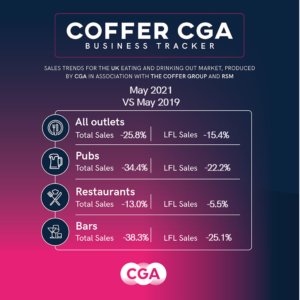

Britain’s managed pub, restaurant and bar groups recorded a 26% drop in total sales in May from the same month in 2019, the new edition of the Coffer CGA Business Tracker reveals.

The figure encompasses two full weeks of inside service for hospitality operators from 17 May, preceded by a fortnight of outdoor-only trading. The freedom to serve indoors gave a boost to the managed restaurant sector, where total sales were down 13% on May 2019. However, ongoing distancing restrictions held down pubs’ sales at 34% below 2019’s levels, despite a sunny Bank Holiday weekend helping them to end May strongly. Bars were the weakest segment for the second month in a row, with total sales down 38%.

On a like-for-like sales basis, groups recorded a 15% drop in May 2021 from May 2019—a modest improvement on April’s figure of -26%. Restaurants were down only 6%, but pubs (down 22%) and bars (down 25%) again lagged behind on this measure.

While the return of inside service has led to the reopening of the majority of restaurants, pubs and bars, CGA’s research shows that a significant number remain closed. Profitable trading is not yet viable for many operators, and businesses in the late-night sector and parts of Scotland that have faced stricter restrictions in May 2021 remain particularly vulnerable. The Coffer CGA Business Tracker shows that rolling 12-month sales to the end of May were 48% below the previous 12 months—a reminder of the huge toll that the COVID-19 has taken on hospitality.

May brought a solid if unspectacular return to inside trading for managed restaurants, pubs and bars,” said Karl Chessell, director – hospitality operators and food, EMEA at CGA, the business insight consultancy that produces the Tracker in partnership with The Coffer Group and RSM. “Consumers have been eager to get back inside restaurants, and sunny weather helped pubs close the month on a high, but distancing and other trading constraints continue to offset those benefits. While the long-term outlook for the sector remains good, so much now hinges on whether the government sticks to its roadmap to recovery. Any delay to the removal of restrictions from 21 June would badly set back hospitality’s fragile recovery just as it starts.”

Mark Sheehan, managing director at Coffer Corporate Leisure, said: “This is a critical period for the sector. Not surprisingly restaurants are coming back faster than pubs and bars given the prohibition on vertical drinking. Hospitality is fighting for survival. The costs of compliance are higher notwithstanding the pressure on labour costs and until we see restrictions lifted we will see closures increasing. The good news is that the public have shown they want to return to hospitality in increasing numbers and the future once restrictions have gone looks very positive.”

Paul Newman, head of leisure and hospitality at RSM, said: “A 15% drop in like-for-like sales compared to May 2019 underlines the challenges currently faced by many operators. Businesses are desperate to operate at full capacity and will remain unprofitable until allowed to do so. With rumours that the roadmap to reopening the economy could be put back by several weeks, further government support is now needed until social distancing measures are fully lifted. A targeted extension to the 100% business rates relief for leisure and hospitality properties beyond the current end of June deadline will go some way to ensuring that pubs are still in business to capitalise on the welcome boost to trade that the Euros will offer.”

A total of 50 companies provided data to the latest edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com.

About Coffer Peach Business Tracker

CGA collected sales figures directly from 57 out of the 61 leading companies participating. Participants include: All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), Bill’s Restaurants, BrewDog, Buzzworks Holdings Group, Byron, Coaching Inn Group, Cote Restaurants, Dominion Hospitality, Drake & Morgan, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, New World Trading Co, Oakman Inns, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu Manchester, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Youngs.