July’s figures were bolstered by the Euros tournament and there were periods of unusually hot weather that positively impacted outlets with outdoor areas, whilst deterring consumers from visiting indoor outlets.

July’s figures were bolstered by the Euros tournament and there were periods of unusually hot weather that positively impacted outlets with outdoor areas, whilst deterring consumers from visiting indoor outlets.

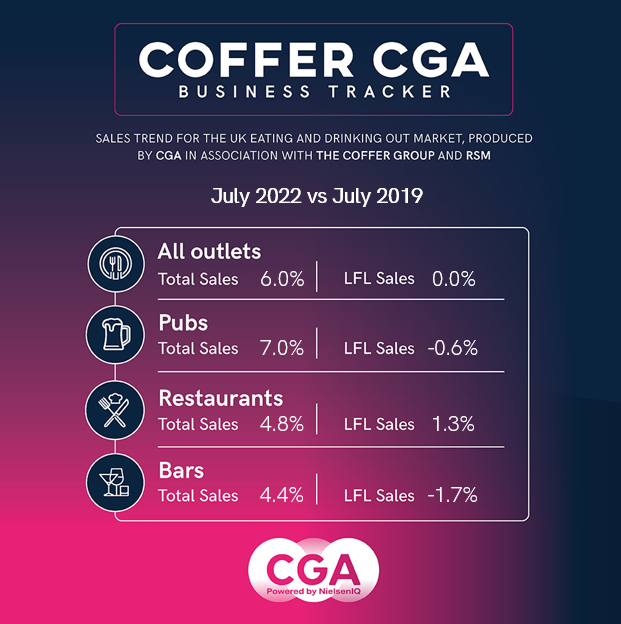

The results from the Tracker—produced by CGA by NielsenIQ in partnership with The Coffer Group and RSM UK—represents a drop in like-for-like sales following the strongest month of like-for-like growth this year in June, and given high levels of inflation since 2019, sales are significantly behind pre-pandemic levels in real terms.

Restaurants were the strongest performing of the Tracker’s three hospitality segments in July, with like-for-like sales at +1.3% vs three years ago. Managed groups’ dine-in only sales were down -8.0% suggesting performance for the segment was in part supported by consumers opting for deliveries.

Pubs continued to perform reasonably well with LFL sales growth down by –0.6%, whilst bars’ fared worse with their LFL sales dropping to -1.7%.

The Tracker demonstrates that trading in London continues to struggle, with -2% LFL sales growth, compared to a decline of -1% in June and a flat performance in May. Beyond the M25, LFL sales were 0.7% as ongoing rail strikes continued to significantly reduce footfall into central London.

Overall like-for-likes are flat compared to 4.7% growth in June (which benefited from bank holidays and the Jubilee) and in decline by -3.3% when sales from deliveries and takeaways are removed from this metric.

Karl Chessell, director – hospitality operators and food, EMEA at CGA, said: “A flat rate of LFL sales reflects the slow but steady trajectory of the past few months. Operators are acutely aware of the challenges that lie ahead during the second half of 2022. Inflation, rising costs, supply chain issues, and staffing challenges are impacting businesses. But the hospitality sector continues to demonstrate extraordinary resilience and remains an important channel for investment long term.”

Mark Sheehan, managing director at Coffer Corporate Leisure, said: “Flat sales on 2019 numbers in the face of rampant inflationary pressure on every front may appear catastrophic but these number show the steady progress hospitality is making. Those that survive may well thrive but for operators these improvements need to continue. 2019 is the benchmark for now but it is not realistic for businesses to survive at these levels. London is improving steadily. Whilst utilities are a concern, recruitment remains the toughest obstacle for most.”

Paul Newman, head of leisure and hospitality at RSM UK, said: “July’s heatwave and rail disruption go some way to explaining these disappointing results but the overall picture is pretty stark. Sales are significantly behind pre-pandemic levels and that can only spell huge challenges ahead for the leisure and hospitality sector. The government’s support throughout the pandemic was absolutely key in saving many businesses. But it could all be for nothing if measures are not reintroduced at pace in the coming weeks and months. On taking up office, the new Prime Minister will have an in-tray full of critical issues to address but as storm clouds gather at an alarming rate, further government support is needed for a sector that otherwise faces an autumn of discontent and potentially more challenging than Covid lockdowns.”

CGA by NielsenIQ collected sales figures directly from 66 leading companies for the latest edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com

About the Coffer CGA Business Tracker

Participants include: All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Bill’s Restaurants, Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), BrewDog, Buzzworks Holdings Group, Byron, Cityglen Pub Co, Coaching Inn Group Ltd, Cote Restaurants, Dishoom, Dominion Hospitality, East London Pub Co, Five Guys, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Individual Restaurant Company, Junkyard Golf Club, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, New World Trading Company, North Brewing Co, Oakman Inns, Parogon Pub Group, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, State of Play Hospitality, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu Manchester, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Youngs.