Click here to read the blog in Italian/ Clicca qui per leggere il blog in italiano.

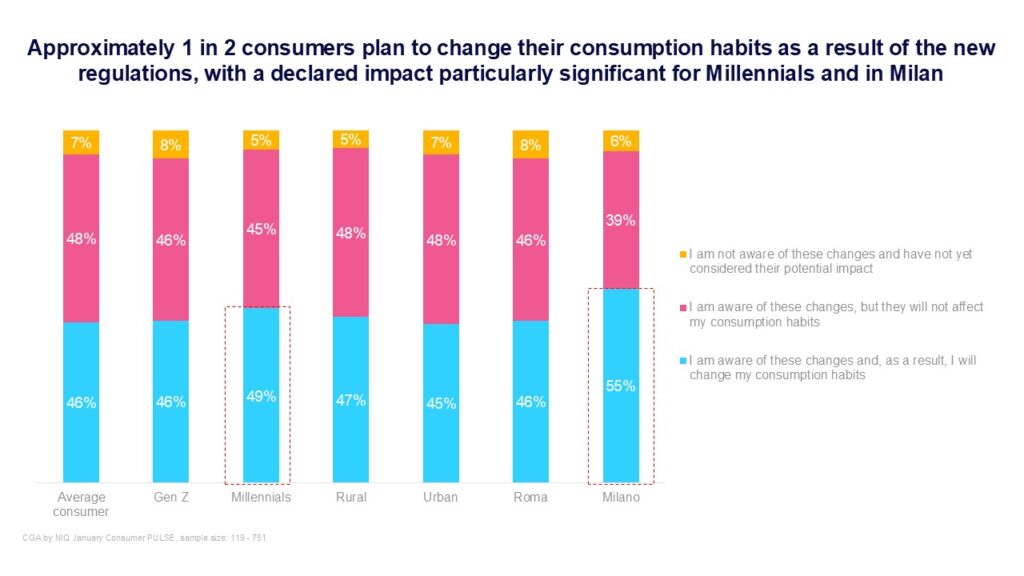

To assess the potential impacts of this legislation on the industry and consumers, CGA by NIQ conducted a comprehensive survey in January 2025. The findings reveal that nearly all consumers in Italy are aware of the new Highway Code, and 46% intend to modify their drinking and socializing habits accordingly. Millennials (49%) and residents of Milan (55%) are especially likely to make adjustments in response to these changes.

Impact on the HoReCa footfall

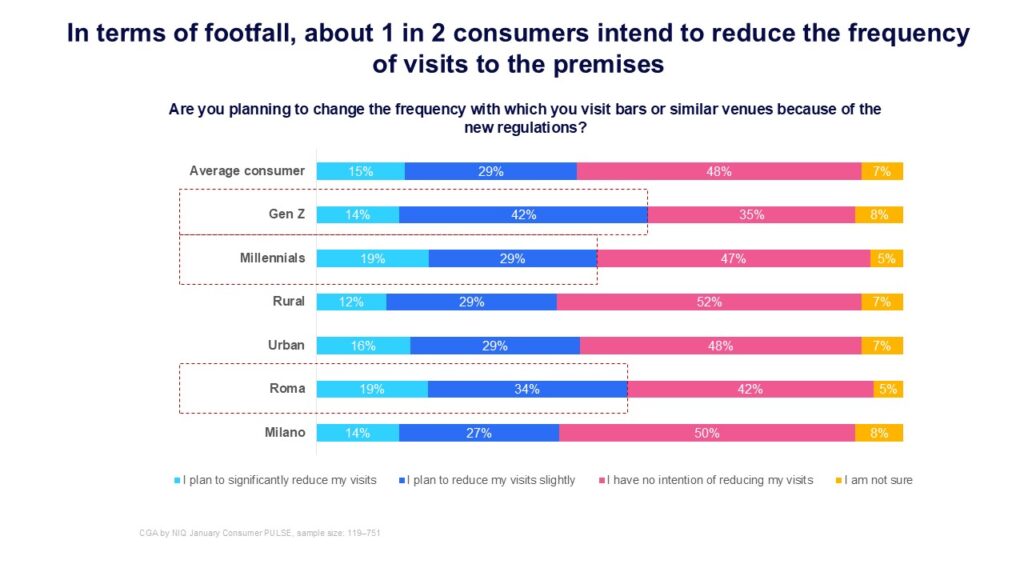

One of the most immediate effects of the new regulations is a projected decline in HoReCa footfall. CGA’s insights indicate that 44% of consumers plan to reduce their visits to bars and restaurants, with the impact most pronounced among Gen Z (+12pp). Moreover, cities renowned for their vibrant nightlife and social drinking culture, such as Rome (+9pp) and Milan (+3pp), are also expected to experience declines.

Evolving drink consumption patterns

Among those who express a desire to change their drinking habits, two main trends emerge. The most common response, cited by nearly 2 in 5 consumers, is an increase in soft drink consumption. Close behind, around 1 in 3 Italians report reducing their intake of alcoholic beverages, without substituting them with either non-alcoholic or dealcolate (de-alcoholized) alternatives.

Gen Z is at the forefront of these shifts. While 37% of consumers express a preference for non-alcoholic drinks—such as soft drinks—this trend is particularly pronounced among younger individuals, who drive the +7pp increase. Additionally, Gen Z shows a higher inclination toward No/Low alcohol alternatives, such as 0% alcohol beer and mocktails (22% vs. 16% average consumer.

Meanwhile, 1 in 3 Italian consumers intends to continue drinking alcohol but in smaller quantities—a trend led by Millennials, and particularly noticeable in cities like Rome and Milan. In Milan, in particular, consumers are opting for lower-alcohol alternatives, such as switching from cocktails to beer, a choice indicated by 17% of respondents (compared to 14% overall).

Meanwhile, 1 in 3 Italian consumers intends to continue drinking alcohol but in smaller quantities—a trend led by Millennials, and particularly noticeable in cities like Rome and Milan. In Milan, in particular, consumers are opting for lower-alcohol alternatives, such as switching from cocktails to beer, a choice indicated by 17% of respondents (compared to 14% overall).

Despite the expected decline in alcohol consumption, both alcoholic and non-alcoholic beverages will continue to coexist. These evolving habits present opportunities for industry players to adapt to shifting preferences.

It will be fascinating to see whether these emerging trends will spark new dynamics among alcoholic beverages of varying strengths, non-alcoholic drinks, and NoLow options—particularly given the unique preferences of Gen Z. Renowned for its emphasis on moderation, wellness, and openness to change, this generation is at the forefront of new and evolving trends.

For instance, the concept of “sober curiosity” encourages a more mindful and restrained approach to alcohol consumption, while “zebra striping” describes the practice of alternating between alcoholic and non-alcoholic drinks within the same evening. Monitoring how consumers experiment with these options and whether this shift toward diverse categories will have a lasting influence on their drinking habits will be crucial.

Diversification as a new consumer habit

Another notable trend emerging from these insights is the diversification of consumer choices. When analysing purchasing categories, the share of consumers engaging with various categories has increased, with aperitifs and wine seeing the most significant growth, compared to beer and spirits.

There could be several reasons behind aperitifs and wine emerging as key choices for those adjusting their habits. One of the factors could be the association of these categories with slower, more social consumption, where second rounds are less frequent. Secondly, they are typically linked to meal-oriented occasions, where alcohol consumption tends to be lower compared to late-night or high-energy drinking occasions.

However, this trend does not necessarily mean that these categories are experiencing higher sales volumes. Rather, it suggests that more consumers are incorporating them into their choices, broadening the range of drinking occasions.

Having consumer’s attention is paramount

With fewer drinks being ordered, beverage manufacturers and venue operators must work harder to capture consumer interest at critical touchpoints in the path to purchase. With nearly 1 in 3 consumers plan to drink less alcohol, brands that can effectively engage consumers early in the decision-making process through targeted marketing, strategic product placement, and innovative promotional strategies will have a competitive advantage.

Among the potential winning strategies that market players can adopt to address the situation is premiumization— emphasizing high-quality products. Italians, in fact, continue to seek elevated consumption experiences, presenting brands with an opportunity to differentiate their offerings by focusing on quality, craftsmanship, and exclusivity.

Shifting venue preferences

With the new regulations, 1 in 4 of consumers plan to favor local neighborhood bars within walking distance, while 1 in 5 express a preference for venues that are less alcohol-centric, such as cinemas, museums, and food-centered establishments. This evolution in consumer behavior presents a new distribution challenge for beverage brands, requiring them to expand their presence beyond traditional HoReCa channels by embracing non-traditional points of sale to maintain visibility and align with evolving consumer habits.

Beatrice Francoli, Sales Account Development, said: “The introduction of the new Highway Code marks a pivotal moment for the HoReCa sector, bringing changes that present both opportunities and challenges. It is crucial for stakeholders to adapt to these developments by reassessing their approach to engaging with consumers.”

Valeria Bosisio, Client Success & Insights Manager at CGA, adds: “Understanding consumer behavior is crucial in this time of change. The regulatory landscape is shifting, and with it, consumption habits are evolving. Whether it’s new trends in venues, non-alcoholic alternatives, or premium experiences, those who can use data strategically will not only adapt but thrive.”

CGA’s full scope of research solutions will be analysing the full effect of this new law as it continues to take shape and what it might mean for your business. To discover more about the service and opportunities for bespoke analysis, contact us today!