CGA by NIQ’s exclusive Third Space Report reveals the full value of the sector, which includes multi-purpose and interactive channels like competitive socialising venues, event, music and food spaces and stadia. In the new era of experience-led hospitality, it has essential insights to help suppliers gain listings, establish new partnerships and influence consumers’ drinks choices.

Missed opportunities

Research for the report shows third space venues achieve on average 17% more drinks volumes per month than other licensed premises. This translates into enormous sales in LAD and spirits categories in particular. Based on average ROS figures, suppliers not serving third space outlets could be losing out on a share of at least 4 million pints every month—which amounts to £227m per year. In spirits, the lost opportunity totals 3.3 million single-serves every month, or £148m annually.

The popularity of third space venues is rising at a time when many other outlets are experiencing heavy pressure on footfall. CGA by NIQ’s OPUS data earlier this year indicated that total On Premise visits were 17% higher than 12 months previously—a welcome sign that consumers are loosening their spending. However, the latest Business Confidence Survey from CGA by NIQ and Sona found that three in five (60%) leaders—and nearly three quarters (74%) of bar leaders—have seen a significant drop-off in footfall year-on-year. This indicates that a substantial amount of footfall is migrating from traditional On Premise venues into the third space.

This makes it vital for suppliers to grasp new opportunities in non-traditional channels—especially when they are targeting younger adults, who are attracted by the experiential aspects of the third space and are frequent visitors. Nearly half (49%) of Gen Z drinkers in third space venues say they use them at least weekly—29 percentage points more than Gen X. Engagement is particularly high in competitive socialising venues, where half (50%) of guests have visited weekly in the last three months.

What consumers want from the third space

Understanding the reasons for these visits is the key to unlocking sales. The Third Space Report reveals special occasions, date nights and live events are the top three occasions, while value for money is the leading influence on decisions to visit.

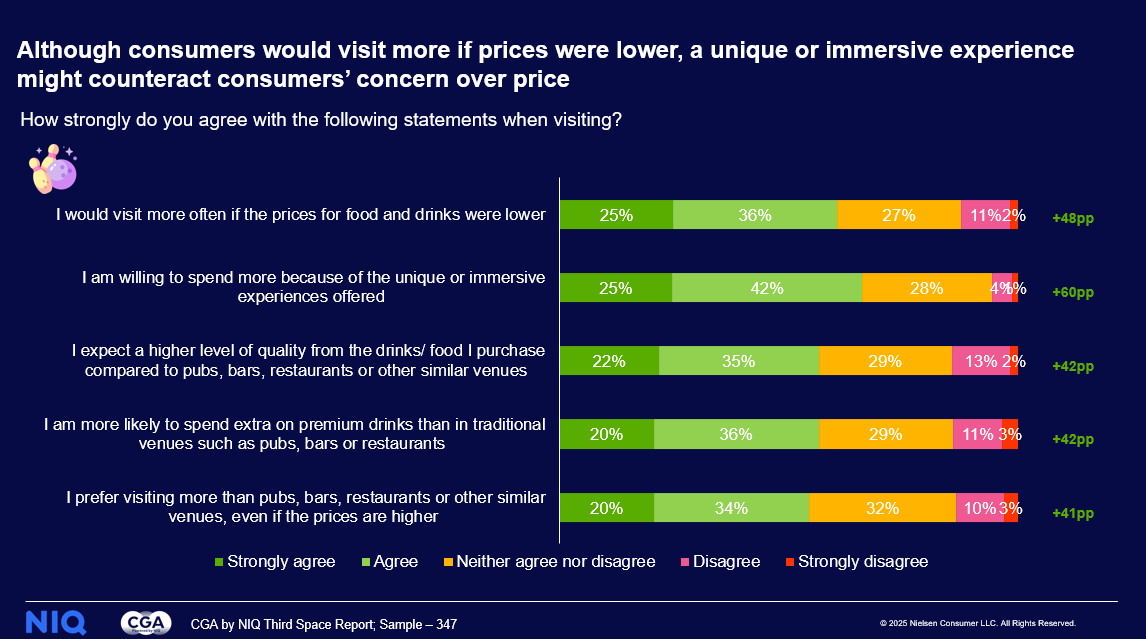

However, value doesn’t necessarily mean cheap, and high quality experiences help guests feel they are getting a good return on their spending. While three in five (61%) consumers say they would visit third space venues more often if prices were lower, an even higher number (67%) would spend more on unique or immersive experiences. Guests are also sharply focused on the range of drinks and offers or promotions, and 57% expect a higher level of drinks and food from these venues than in pubs, bars and restaurants.

The growing popularity of third space venues is also having a trickle-down impact on more traditional parts of the On Premise. Around a third (32%) of business leaders say they have added entertainment aspects to their offer in the last 12 months—double the number from the previous year. This opens up more opportunities for sponsorships of activations and events, which around a quarter of operators are currently seeking.

Discover more

The Third Space Report from CGA by NIQ is packed with many more insights into this vital part of the market. It includes expert analysis of all the leading third space segments and builds a detailed picture of their users’ demographics, needs and paths to purchase, helping suppliers to optimise distribution and sales strategies. Purchasers of the report also receive a refreshed list of third space venues that are currently open and trading.

Rachel Weller, CGA by NIQ’s commercial leader, UK and Ireland, said: “Third space venues are having a significant impact on Britain’s hospitality habits, and transforming the leisure spend of younger adults in particular. While this has created challenges for some traditional On Premise channels, it is also opening up some exciting opportunities. Supplier strategies need to pivot quickly, and it’s essential for all businesses to achieve a proper understanding of what people want from the third space. With competition intensifying fast, investment in this dynamic sector can help recruit new consumers and drive sales .”

Rachel Weller, CGA by NIQ’s commercial leader, UK and Ireland, said: “Third space venues are having a significant impact on Britain’s hospitality habits, and transforming the leisure spend of younger adults in particular. While this has created challenges for some traditional On Premise channels, it is also opening up some exciting opportunities. Supplier strategies need to pivot quickly, and it’s essential for all businesses to achieve a proper understanding of what people want from the third space. With competition intensifying fast, investment in this dynamic sector can help recruit new consumers and drive sales .”

Based on a survey of 4,000 consumers, CGA by NIQ’s Third Space Report provides a dive deep into all leading third space channels, with expert analysis of guests’ evolving engagement, needs and preferences there. To learn more, click here and contact the CGA by NIQ team.