When analyzing spirits sales, it’s impossible to leave vodka out of the conversation. As one of the most essential and versatile categories, vodka is synonymous with a wide range of mixed drinks—think soda, cola, tonic—and is a key ingredient in many of the country’s most popular cocktails, including Cosmopolitans, Mules, and the Bloody Mary.

However, consumer preferences are shifting, and vodka’s long-standing position at the top is now under serious threat.

Tequila Shares the Top Spot

Since CGA by NIQ launched their On Premise Measurement (OPM) Spirits solution in the U.S. back in 2016, two things have held steady: whiskey has led in dollar sales, and vodka has topped the charts in volume. Thanks to its incredible versatility, vodka has remained a crowd favorite, with 26% of on-premise consumers saying they’ve had it in the past three months.

But the landscape is starting to shift. Tequila has officially gone mainstream and is now neck and neck with vodka in terms of volume share. Both currently account for 23.5% of total spirit sales across the U.S. on-premise.

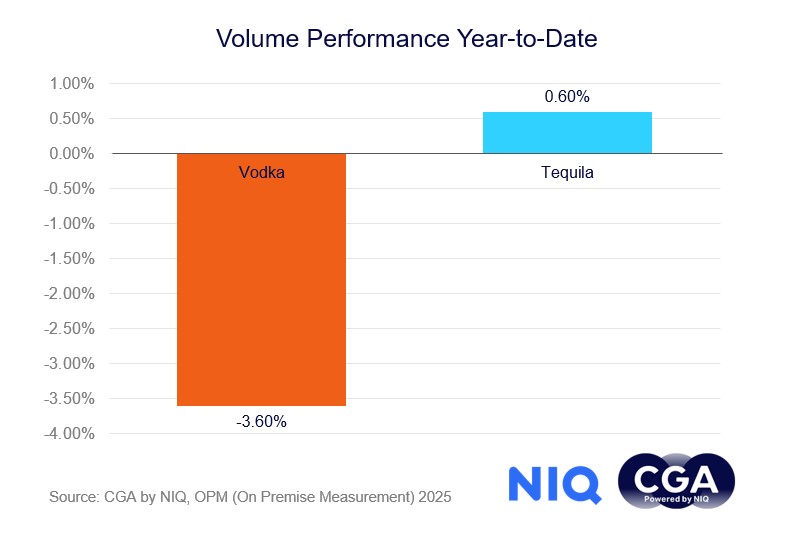

The real headline? Tequila looks poised to take the lead. Year-to-date, vodka volumes are down 3.6%, while tequila continues to climb, up 0.6%. If the trend continues, vodka may soon lose its volume crown.

A Different Story at the State Level

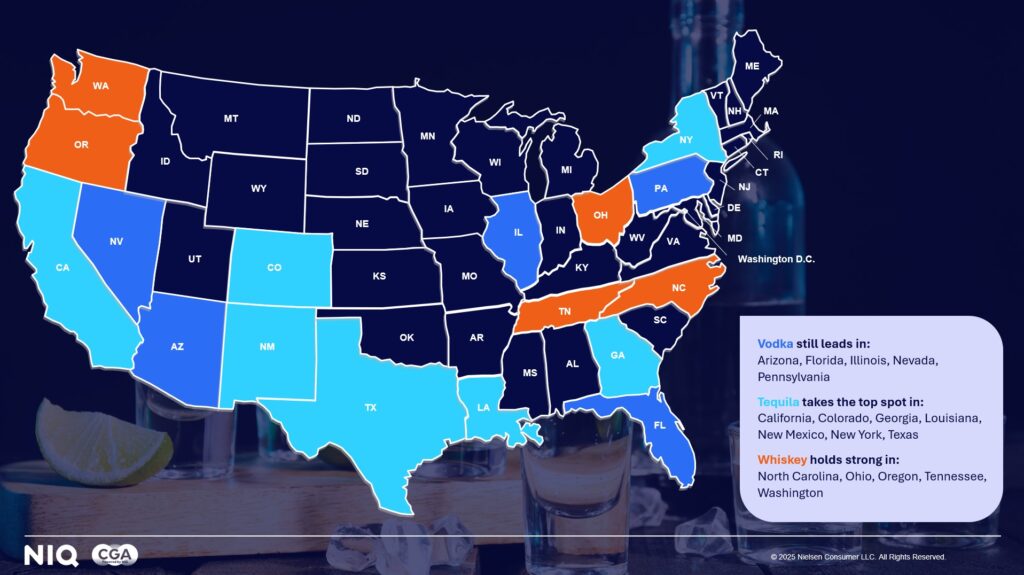

In a country as vast and diverse as the U.S., national trends only tell part of the story. To understand what’s happening with vodka, we need to zoom in on regional dynamics—because in some states, vodka is still holding its ground as the top spirit by volume.

Looking at the states CGA by NIQ tracks individually, here’s how things break down:

Vodka still leads in: Arizona, Florida, Illinois, Nevada, Pennsylvania

Tequila takes the top spot in: California, Colorado, Georgia, Louisiana, New Mexico, New York, Texas

Whiskey holds strong in: North Carolina, Ohio, Oregon, Tennessee, Washington

These state-level preferences highlight just how varied the U.S. spirits landscape really is—and why it’s crucial to consider local trends when making on-premise decisions.

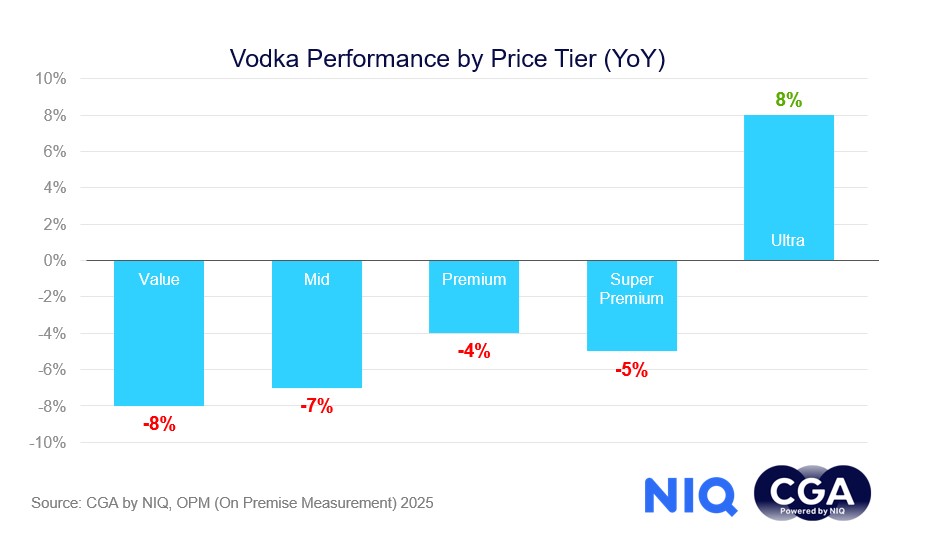

Opportunities in Premium

As ever, vodka is a broad spectrum with many brands being made available at a whole variety of price points. When looking at performance by price tier (year on year), we do see a significant difference in sales performance:

Value: -8%

Mid: -7%

Premium: -4%

Super Premium: -5%

Ultra: +8%

This shows that although small premiumization is still evident in the vodka category, for some consumers, the appetite is there to trade up to higher-priced, luxury items.

Cocktails and Flavors for The Win!

Beyond premium and luxury vodka, there are plenty of other growth opportunities, particularly through cocktails and flavored variants. According to the latest CGA Cocktail Report, both flavored and unflavored vodka rank among the top four cocktail bases for consumers.

Vodka-based cocktails make up a significant portion of the top 10 in terms of sales, but perhaps the most notable trend is the rise of the Espresso Martini. Now the number-two cocktail (just behind the Margarita), the Espresso Martini has become a hallmark of quality for many on-premise locations, and vodka will continue to play a key role in this trend.

To Finish…

So, while vodka continues to be one of the main players in the U.S. on-premise scene in terms of volume, the landscape is evolving. Tequila is gaining ground, and regional differences show that in some states, it is already well ahead. At the same time, premiumization is evident, with some consumers opting for higher-priced options. Beyond price, cocktails—especially the Espresso Martini—represent a growing opportunity, with vodka playing a pivotal role in many of the top-selling drinks. As trends shift, it’s clear that vodka’s versatility and continued popularity will keep it at the heart of the On Premise experience, even as new challenges and opportunities emerge.

Originally published in Bar and Restaurant news

CGA by NIQ On Premise sales measurement and consumer research solutions provide many more insights into the no and low alcohol category in the US, with expert analysis of categories, channels, occasions and much more. To learn more about core services and opportunities for tailored analysis, contact the CGA team.