Jonny Jones, Managing Director of International Markets at CGA by NIQ, draws on insights from their Global REACH study to reveal how brands, suppliers, and operators can harness consumers’ appetite for flavour exploration in the On Premise sector.

Jonny Jones, Managing Director of International Markets at CGA by NIQ, draws on insights from their Global REACH study to reveal how brands, suppliers, and operators can harness consumers’ appetite for flavour exploration in the On Premise sector.

January has traditionally been a slower month for the On Premise sector, as the revelry and indulgence of the festive season give way to a period of natural moderation and new year’s resolutions. While 2025’s inaugural month is no exception, the overall outlook for the global On Premise landscape remains notably positive. According to our Global REACH consumer study, which surveys over 30,000 individuals across 38 countries, On Premise venues continue to hold a central role in people’s lives. Indeed, we recently reported that engagement with bars, pubs, and restaurants remains robust, with 83% of people visiting venues at least once every three months, and one in three going out weekly.

When people go out, spirits are one of their go-to alcoholic drink categories. Whisky leads the pack, with nearly 30% of On Premise drinkers worldwide choosing it when ordering at the bar. Close behind is vodka, preferred by 27% of On Premise users, followed by gin, which is enjoyed by one in five. Tequila is another favourite, consumed by 19% of drinkers, while brandy, rum, liqueurs, and other spirits also hold significant appeal, with each category attracting 17% of users.

Compared to traditional alcoholic beverages like wine or beer, consumers interact with the spirits category in distinct ways. Some prefer to enjoy spirits neat – our research shows this applies to about 12% of On Premise drinkers globally – but mixed drinks are considerably more popular. Their appeal lies in their versatility. Not only can mixing spirits with other liquids reduce their alcoholic strength, making them more sessionable as a result, it opens the door to endless flavour combinations, too, allowing drinkers to explore a wide array of tastes.

Flavour is king

REACH shows that flavour exploration is becoming increasingly crucial in the drinks industry for attracting and retaining consumers. Offering diverse taste options provides greater choice and keeps consumers engaged. It is a dynamic that encourages them to remain loyal to a category they appreciate or even try a particular beverage they might not be familiar with yet. Indeed, one in five On Premise consumers indicate that access to more experimental spirit options would motivate them to engage with a category more frequently.

REACH shows that flavour exploration is becoming increasingly crucial in the drinks industry for attracting and retaining consumers. Offering diverse taste options provides greater choice and keeps consumers engaged. It is a dynamic that encourages them to remain loyal to a category they appreciate or even try a particular beverage they might not be familiar with yet. Indeed, one in five On Premise consumers indicate that access to more experimental spirit options would motivate them to engage with a category more frequently.

This trend is particularly evident in the gin category, where innovation and unique flavour profiles have significantly driven consumer interest and growth over the past few years. Currently, non-flavoured gin expressions are consumed slightly more frequently (31%) than flavored ones (24%). That said, 10% of drinkers plan to increase their consumption of the latter over the next year, compared to just 7% who intend to drink more non-flavoured gin. There’s a growing interest in diverse and innovative products within this category, so brands should prioritise the appeal of flavour exploration when targeting consumers. To truly stand out, they can pair flavour innovation with other key factors that influence consumers to try new drinks. These factors can include price sensitivity, as value for money is crucial for one in three consumers, while offers and promotions appeal to 31% of drinkers. But they can also provide health-conscious options – such as low-calorie or organic products – which resonate with 21% of On Premise users globally.

The no- and low-alcohol category offers brands the ideal playground to embrace an approach that combines flavour innovation with health consciousness. When asked what would encourage them to order no- and low-abv options more often in bars, restaurants, or similar venues, 13% of consumers cite the availability of greater flavour variety or more creative and innovative offerings, including exciting new flavours.

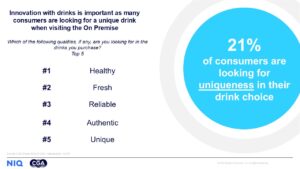

But why does innovation and flavour experimentation play such a crucial role in keeping consumers engaged with a drink? The answer lies in the growing consumer desire for uniqueness and authenticity – concepts that resonate deeply with people worldwide, even if their definitions may vary considerably from person to person. Providing them with distinct and innovative flavours allows brands, operators and suppliers to cater to this appetite for individuality, creating a sense of novelty and personal connection that keeps drinkers coming back for more. Admittedly, the top three qualities consumers seek in an alcoholic drink when visiting On Premise venues are healthiness, freshness, and reliability, but authenticity and uniqueness closely follow as the fourth and fifth most valued attributes, meaning they should not be underestimated. Notably, one fifth of consumers specifically say they look for uniqueness in their drink, which proves the importance of offering distinctive and memorable options to capture people’s interest.

But why does innovation and flavour experimentation play such a crucial role in keeping consumers engaged with a drink? The answer lies in the growing consumer desire for uniqueness and authenticity – concepts that resonate deeply with people worldwide, even if their definitions may vary considerably from person to person. Providing them with distinct and innovative flavours allows brands, operators and suppliers to cater to this appetite for individuality, creating a sense of novelty and personal connection that keeps drinkers coming back for more. Admittedly, the top three qualities consumers seek in an alcoholic drink when visiting On Premise venues are healthiness, freshness, and reliability, but authenticity and uniqueness closely follow as the fourth and fifth most valued attributes, meaning they should not be underestimated. Notably, one fifth of consumers specifically say they look for uniqueness in their drink, which proves the importance of offering distinctive and memorable options to capture people’s interest.

The value of innovation

Certain categories are widely regarded as more innovative than others. Cocktails, for instance, are seen as the most innovative alcoholic beverage of all. This might be because, while classic recipes like the Mojito, Negroni, or Gin & Tonic, are rather ubiquitous, bartenders like to create unique cocktail programmes to differentiate their venues from the competition, which can stimulate more footfall. Hard seltzers are perceived as the second most innovative category, likely due to their relatively recent emergence. With no deep-rooted heritage or historical baggage, the category is also simple enough to allow for swift innovation without significant barriers, neither originating from producers, nor from the public.

Certain categories are widely regarded as more innovative than others. Cocktails, for instance, are seen as the most innovative alcoholic beverage of all. This might be because, while classic recipes like the Mojito, Negroni, or Gin & Tonic, are rather ubiquitous, bartenders like to create unique cocktail programmes to differentiate their venues from the competition, which can stimulate more footfall. Hard seltzers are perceived as the second most innovative category, likely due to their relatively recent emergence. With no deep-rooted heritage or historical baggage, the category is also simple enough to allow for swift innovation without significant barriers, neither originating from producers, nor from the public.

As these categories are perceived as innovative, consumers have come to expect continuous innovation within them. This has set the bar for experimentation particularly high, with drinkers now anticipating fresh and exciting options that push boundaries, making it essential for brands and bars to consistently deliver new and creative experiences to meet these evolving expectations.

In comparison, the research indicates that consumers view both spirits and no- and low-alcohol alternatives as relatively less innovative. However, this should not be seen as a challenge but rather as untapped potential. This, however, should not be seen as a challenge. On the contrary, it is an opportunity for brands to stand out more easily from the crowd: by leveraging creativity and differentiation, they can seize consumer interest and drive growth.

Specifically, spirits rank third in our perceived innovation chart, so there is still significant potential for experimentation to give new distillates a “wow” factor that can capture consumer attention. Even more potential lies within the no- and low-alcohol category, which, as we have seen earlier, could resonate strongly with drinkers when approached through flavour exploration. With the broader no- and low-alcohol segment ranking seventh in terms of perceived innovation, the opportunities for brands to experiment to stand out are vast and untapped.

It really is impossible to overstate the crucial role that beverage flavour plays – and will likely continue to play – in the global On Premise. Nearly one in four consumers worldwide say they enjoy drinking alcohol specifically because they like experimenting with different tastes or trying various types of alcoholic drinks. In other words, they are constantly eager to provide their palates with new and exciting flavour experiences. Brands, suppliers, and operators should take note of this trend and swiftly adapt their research, development, and promotion strategies to align with people’s growing appetite for flavour exploration, as meeting this demand will be key to staying competitive in the ever evolving On Premise market over the coming months.

They should be mindful, of course, that while flavour is essential, it is not necessarily sufficient on its own to attract consumers and drive engagement with a drink. Other factors always play a role in shaping purchasing decisions and encouraging repeat consumption. These include value, perceived brand authenticity, and – perhaps most importantly – how the drink is presented to them. For instance, our research shows that a drink’s flavour description can heavily influence consumer choices at the bar, with 14% of On Premise users globally indicating that they would appreciate more tasting notes or product explanations on menus. In short: consumers are certainly eager to experiment, but they like their choices to be informed and somehow guided.

So, when it comes to flavour, businesses must look beyond product development and focus on the liquid’s entire journey to the consumer – greater collaboration across the supply chain to develop tailored strategies for reaching target consumers can really maximise the potential of flavour exploration.

CGA by NIQ’s suite of research services offers brands, suppliers, and operators an unparalleled and comprehensive view of the global On Premise industry and drinks categories. Global REACH survey compares key On Premise consumer metrics across 38 markets, uncovering worldwide trends and providing insights into how consumer attitudes, motivations, and need states drive On Premise behaviours and category dynamics. To learn more about CGA by NIQ’s other sources of consumer and measurement insights for brands, operators, and suppliers get in touch here.

Originally published in Global Drinks Intel Magazine