For many, January represents a month of new beginnings and fresh starts. New Year’s resolutions are announced, gym memberships signed up for, and bad habits banished. Alcohol consumption is often on the docket, and you’d be hard-pressed to find someone who says they plan to increase their alcohol intake over the next 12 months!

However, while this may have once been a short-term trend for ‘Dry January,’ it’s now clear that non-alcoholic alternatives have become a staple in consumers’ repertoires year-round.

Health and Wellness is Big Business

Across all of Fast-Moving Consumer Goods (FMCG), health and wellness trends are becoming increasingly relevant for a more self-aware, particularly younger, consumer. In a social-media age where sober-curiosity is on-trend and excessive consumption is not, drink choices are changing.

Increasingly, macro social and political trends are impacting consumer decision making and the factors behind drinks choices are more value-based than ever before. In supermarkets/grocery stores, the Non-Alc category is now worth $823 million. This is only 0.7% of total alcohol sales but has grown by +27% versus the previous year in what has been a challenging climate.

Dry January – The On-Premise Needs to Adapt

For the on-premise sector, the early months of the year often represent the most challenging time for bar and restaurant owners. With foot traffic already a year-round struggle, the rise of Dry January only adds to proprietors’ mounting concerns.

To counter this, operators need to cater to those moderating their alcohol consumption, as this trend shows no signs of fading. Even if the general public isn’t drinking alcohol, 87% of those taking part in Dry January say they will still visit bars and restaurants. With the stigma around occasions like this now removed, bars must adjust their menus to accommodate this type of customer.

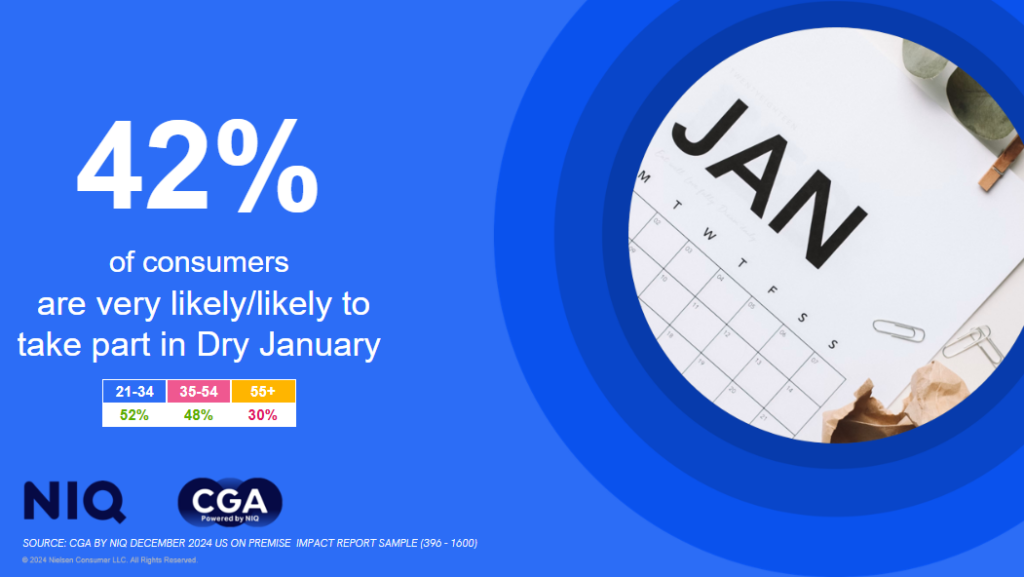

Back in December, we surveyed 1,500 on-premise visitors across Texas, Florida, California, and New York, and a significant 42% of consumers said that they were either likely or very likely to take part in Dry January. What is perhaps even more startling, is this number rises to 52% for 21-34 year olds.

A Long-Term Trend

With the social-media-influenced, younger consumer having a different relationship with alcohol compared to previous generations, moderation extends beyond Dry January and continues throughout the rest of the year. In fact, 15% of all on-premise visitors reported consuming a non-alcoholic alternative in the three months prior to October 2024. This goes beyond the traditional non-alc categories to include functional beverages.

When asked why they would choose to do this, the top two reasons were both related to well-being: 42% stated they want a healthier lifestyle, while 41% said they want to abstain from alcohol.

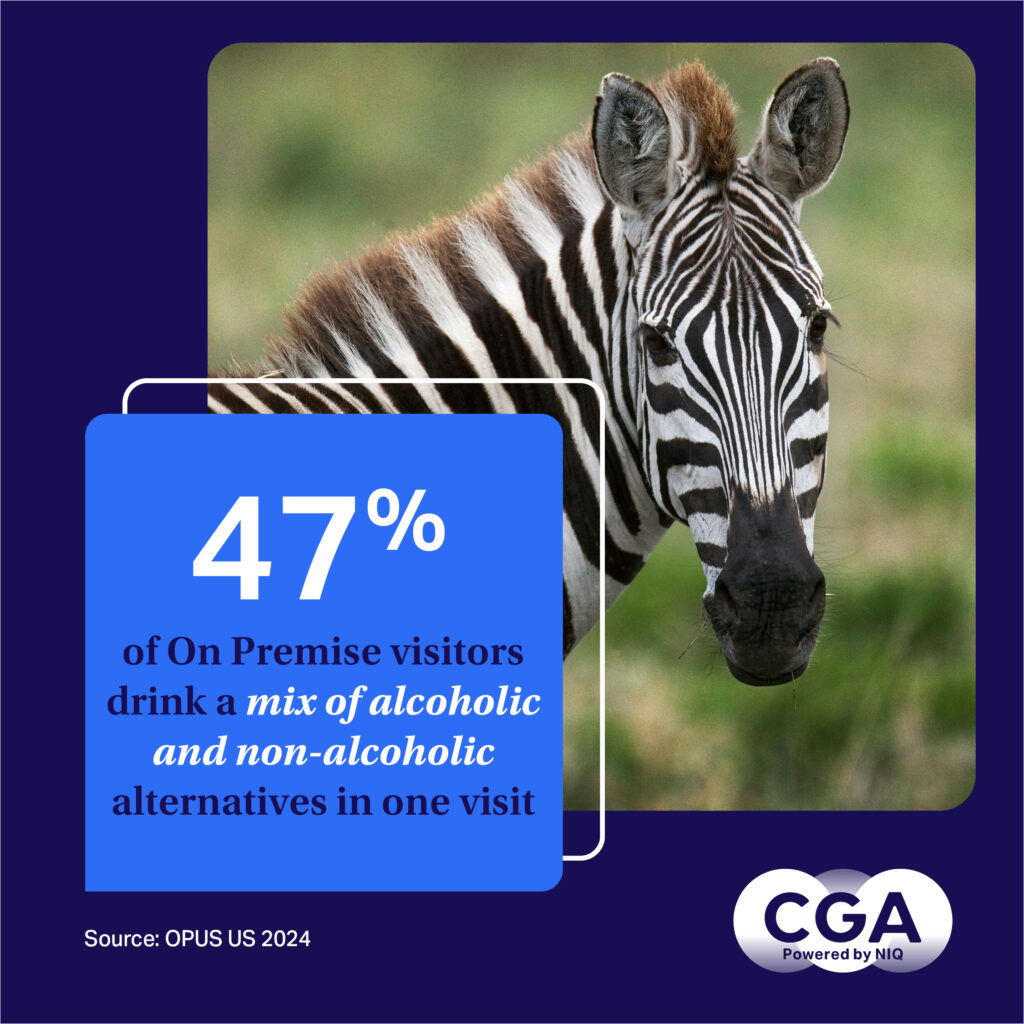

Non-Alc Drinkers Also Drink Alcohol

It is a common misconception that those who choose non-alcoholic alternatives do so because they are teetotalers. While this may be true for some—and we should also consider designated drivers and pregnancy—we know from our On-Premise User Survey that 47% of on-premise visitors drink a mix of alcoholic and non-alcoholic alternatives in one visit.

Many of these consumers have dubbed this trend “striping” or “zebra-striping.” By switching from alcohol to non-alcohol, and then back again, it allows patrons to elongate their on-premise visit without the risk of intoxication.

Beer the Category to Beat?

The sheer number of options in the non-alcoholic category has grown exponentially over the last few years, and this growth has been consistent across all segments. Many sophisticated cocktail bars now feature specialized “mocktail” menus made with high-quality, non-alcoholic alternative brands.

However, it is in the beer category where we are seeing the most significant movement. Although still a small player, with just a 0.5% share of total beer sales, non-alcoholic beer is experiencing explosive growth—up an impressive 33.5% compared to last year.

Lessons to Be Learned From Abroad

This trend is global, with some markets already ahead of where the US currently stands. For example, in the British on-premise sector, one in eight packaged beers sold are categorized as either no- or low-ABV.

The next step in the evolution of non-alcoholic beverages will be making these beers available on draft lines. While there are valid regulatory, production, and public health and safety concerns associated with this, it is already starting to happen, with some tap handles across Europe being switched to non-alcoholic options.

To Finish…

Whether it’s people cutting back or stopping altogether, we know that 37% of consumers are expressing a desire to drink less alcohol this year. As a result, the demand for enjoyable non-alcoholic options is more crucial than ever.

For venues looking to attract this mindful crowd, offering a robust non-alcoholic selection isn’t just an option—it’s a necessity.

Originally published in Bar and Restaurant news

CGA by NIQ On Premise sales measurement and consumer research solutions provide many more insights into the no and low alcohol category in the US, with expert analysis of categories, channels, occasions and much more. To learn more about core services and opportunities for tailored analysis, contact the CGA team.