The exclusive REACH global report—delivering analysis of key trends and developments in 38 countries based on responses from around 30,000 On Premise consumers and 600 operators—reveals the number of people going out to eat earlier exceeds those going out later in every region. The trend is particularly apparent in Africa and South East Asia, where 34% and 32% of consumers are eating out earlier in the day, with just 7% going out later in each region. It is echoed in other key markets like North America, Britain and Ireland and Western Europe, where numbers who have brought forward their visits are more than triple those pushing them back.

CGA’s REACH solution has many more insights into this widespread movement towards earlier dayparts and lower tempo occasions, helping drinks suppliers and brands respond to changing need states. Here are five of the most significant effects.

1 Mid-afternoon opportunities

Dayparts like mid-afternoons have traditionally been quieter for pubs, bars and restaurants, but they are increasingly valuable. In Australia, for example, the mid-afternoon share of total drinks sales has risen from 20% to 23% in just 12 months. Understanding precisely what consumers want on these visits can unlock extra sales in all categories.

2 More with-food occasions

As consumers shift towards earlier dayparts, an effective ‘with-food’ strategy is more important than ever. Food-and-drink pairings and recommendations via menus and staff can be effective influences on consumers’ drinks selections while they eat.

3 The changing role of spirits

The preference for earlier drinking has put pressure on the spirits category, which is more commonly associated with late-night and high-tempo occasions. However, suppliers that can adjust the positioning of spirits for afternoons and early evenings—like through longer serves that suit relaxed drinks—can still grow sales.

4 Moderation

The swing to earlier On Premise visits runs in parallel with another big trend identified by the REACH research: moderation of alcohol intake. More than a third (37%) of consumers are drinking less alcohol than 12 months ago—far above the 13% who are drinking more. This is amplifying the opportunities for soft drinks and no or low alternatives to alcoholic drinks in the afternoons and early evenings.

5 Hybrid all-day venues

With footfall now spread more evenly throughout the day, venues need to flex their offer so they appeal to the widest possible range of occasions. CGA’s survey of leaders shows all-day formats are likely to be more successful than those focused on specific dayparts. However, with operating costs high, all venues need to carefully monitor their trading hours to maximise returns.

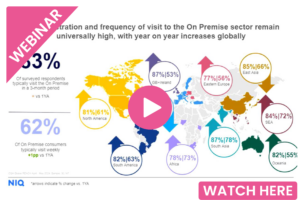

Click here to learn more about the REACH research. To watch an exclusive webinar on the findings, led by CGA’s Charlie Mitchell and George Argyropoulos, click here.

Click here to learn more about the REACH research. To watch an exclusive webinar on the findings, led by CGA’s Charlie Mitchell and George Argyropoulos, click here.

To discover how REACH and other CGA solutions can support winning On Premise strategies, and opportunities for country and regional specific analyses, contact the CGA team.