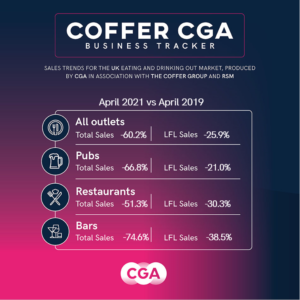

Managed pub and restaurant groups recorded a 26% drop in like-for-like sales in April compared to the same month in 2019 and 51% of sites open as of the end of April, the latest edition of the Coffer CGA Business Tracker shows.

The figure covers three full weeks of outside-only service in England as well as briefer trading in Scotland and Wales, and represents a solid return to trading for the sector. Operators enjoyed the benefit of generally good weather and strong consumer confidence in the first fortnight of trading, though low temperatures and rain dampened sales towards the end of the month.

The Tracker shows pubs have outperformed restaurants since reopening, thanks in part to greater availability of outside space. Pubs’ April sales were 21% down on April 2019, compared to a 30% drop for restaurants. Bars were the weakest segment, with like-for-like sales down 39%.

On a total sales basis, with the majority of sites still closed, groups saw a 60% drop in April 2021 from April 2019. Restaurants (down 51%) performed better than pubs (down 67%) on this measure, due to strong delivery and takeaway sales.

The latest edition of the Coffer CGA Business Tracker also highlights the scale of damage to groups’ sales since the start of the pandemic. Total sales over the last 12 months have been 56% lower than in the previous year.

“Managed groups made the best they could of trading opportunities in April, amid some tough restrictions and the vagaries of the British spring weather,” said Karl Chessell, director – hospitality operators and food, EMEA at CGA, the business insight consultancy that produces the Tracker in partnership with The Coffer Group and RSM. “They have been very resourceful in their use of limited space, and for pubs in particular it has been a good springboard for a fuller reopening from 17 May. But the drop in sales of more than half versus the 2019 pre-pandemic benchmark is a reminder of just how hard the industry has been hit by lockdowns and restrictions. While consumers are eager to get back to hospitality, it is clearly going to be a long and uneven road to recovery, and the sector will need sustained support from government if it is to help reignite the UK economy over the rest of 2021.”

Mark Sheehan, managing director, Coffer Corporate Leisure, said “These like-for-likes are testimony to the creativity of hospitality. The imagination to create outside areas has been inspiring and plays to the strengths of the sector. The support of consumers across the country shows appreciation of the sector generally and operators individually. Undoubtedly there has been pent up demand and it will take some time for businesses to understand where trade levels really are.”

Paul Newman, head of leisure and hospitality, RSM, said “Operators will be greatly encouraged by the response they have had to the reopening of their outdoor spaces and will now be turning their attention to welcoming back customers indoors from Monday. Many businesses remain in a financially precarious position and are unlikely to be back in profit before 21 June when all Covid-19 related restrictions are finally lifted. Despite these financial pressures, I’ve been amazed by the resourcefulness to seek out new revenue opportunities during lockdown. A whole business eco-system continues to be reliant on our support – from suppliers to operators and landlords – and I urge consumers to rediscover real hospitality in person at their local pubs and restaurants over the coming weeks.”

A total of 48 companies provided data to the latest edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com

About Coffer CGA Business Tracker

CGA collected sales figures directly from 48 out of the 60 leading companies participating. Participants include: Amber Taverns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars Ltd, Big Table Group (Bella Italia, Las Iguanas), Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), BrewDog plc, Buzzworks Holdings Group, Dominion Hospitality, Drake & Morgan, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Laine Pub Co, Le Bistrot Pierre, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, Oakman Inns, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), TGI Fridays UK, The Alchemist, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Youngs.