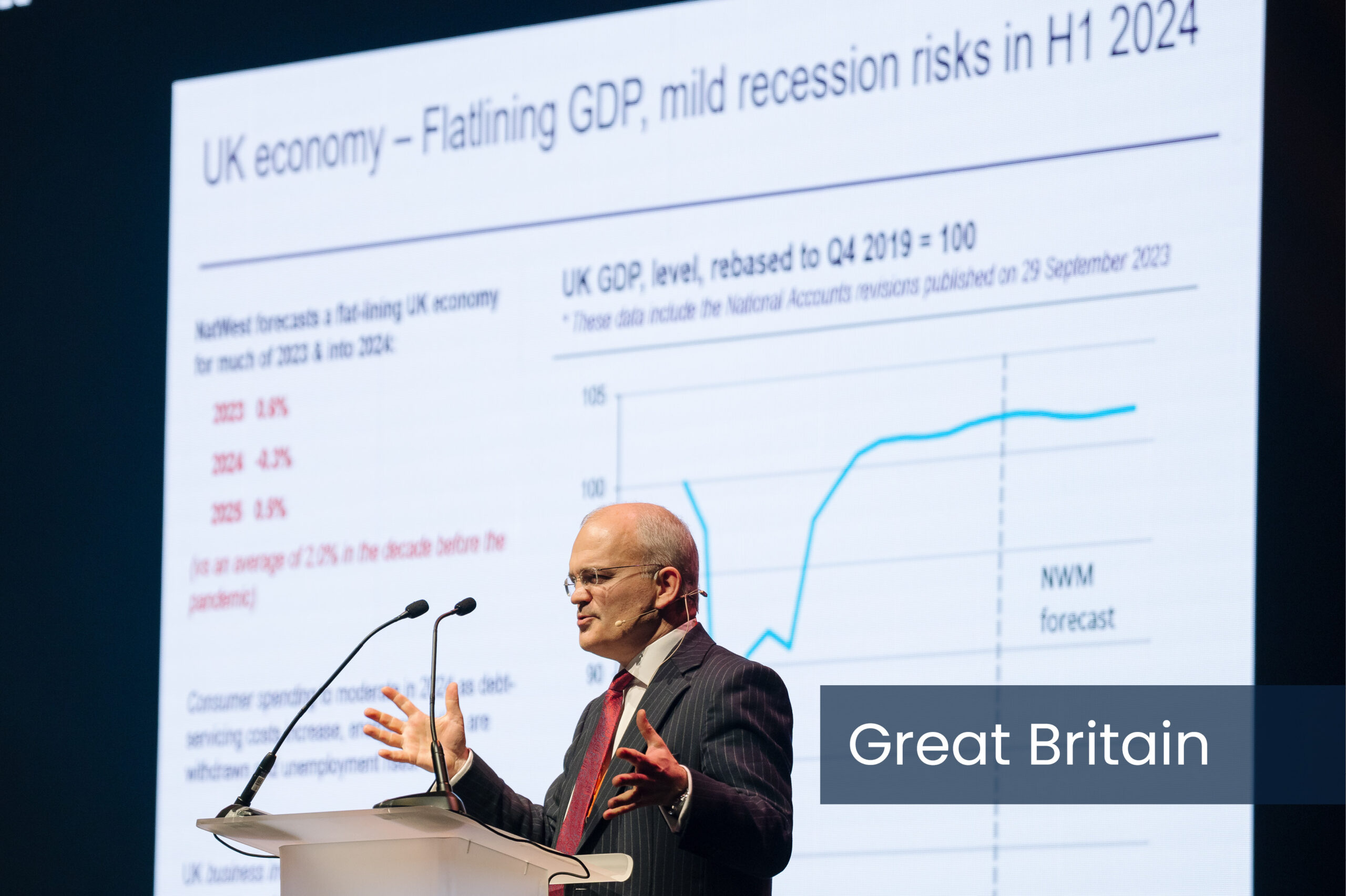

1 ‘GDP growth is negligible’

The economy has been full of ups and downs, but the end-result is that in GDP terms it’s essentially flat. NatWest estimates growth of just 0.5% this year—well below the average annual growth of 2% in the decade before the COVID-19 pandemic. And it’s not about to get any better. ”We’ve seen really negligible growth over the last year or so, and we’ll probably see something similar over the next 12 to 18 months,” Walker said.

2 ‘There’s a mild recession risk’

NatWest forecasts of a GDP dip of 0.3% across 2024, and with interest rates squeezing consumer spending and business investment, there’s the possibility of a recession next year. But it’s not a cause for undue concern, Walker thinks. “We may get a technical recession, but it’s probably going to be relatively mild and relatively short-lived.”

3 ‘Things could have been dramatically worse’

Neither of these indicators appear very positive. But in light of global traumas like COVID, Russia’s invasion of Ukraine, energy shocks and the cost of living crisis, it represents a pretty good performance, Walker said. “When you think of the scale of the shocks that have hit the UK over the last couple of years… the economy and the labour market have been remarkably resilient. Things could have been dramatically worse than what has panned out.”

4 ‘F&B is outperforming’

Encouragingly for our part of the economy, consumers’ spending on food and drink remains solid. The ONS says output from food and beverage services is now 3% above pre-pandemic levels, compared to 1.75% for the economy as a whole. It also compares favourably with other services like accommodation, where output is still 2.5% below where it was before COVID. “The food and beverage sector has been outperforming the economy as a whole… there’s still momentum there and consumers haven’t fundamentally changed their behaviour [of eating and drinking out],” Walker said.

5 ‘The inflation shock is unwinding’

Another positive sign can be found in inflation, with CPI rates slowing sharply to 4.6% in October. “The inflation shock is now really quite advanced in terms of unwinding,” Walker said. Nevertheless, prices are still rising—especially in foodservice, where rates have hovered around 20% this year.

For more news and insights from the Peach 20/20 Leaders Summit, click here.