It ends a slow first quarter of 2025 for the sector, after a like-for-like increase of only 1.7% in February and a 0.6% drop in January. However, the latest performance was better than wider restaurant trends as measured by the separate CGA RSM Hospitality Business Tracker, which recorded a year-on-year drop of 5.7% in managed restaurant groups’ sales in March.

performance was better than wider restaurant trends as measured by the separate CGA RSM Hospitality Business Tracker, which recorded a year-on-year drop of 5.7% in managed restaurant groups’ sales in March.

Weak delivery and takeaway growth reflects ongoing pressure on many consumers’ spending despite a slowing of inflation, as well as concerns about the outlook for the wider economy. Sales may also have been impacted by warm weather in March, which drew some people out to drink in pubs rather than use restaurants. The timing of Easter—which fell in March in 2024 but April this year—also affects the comparisons.

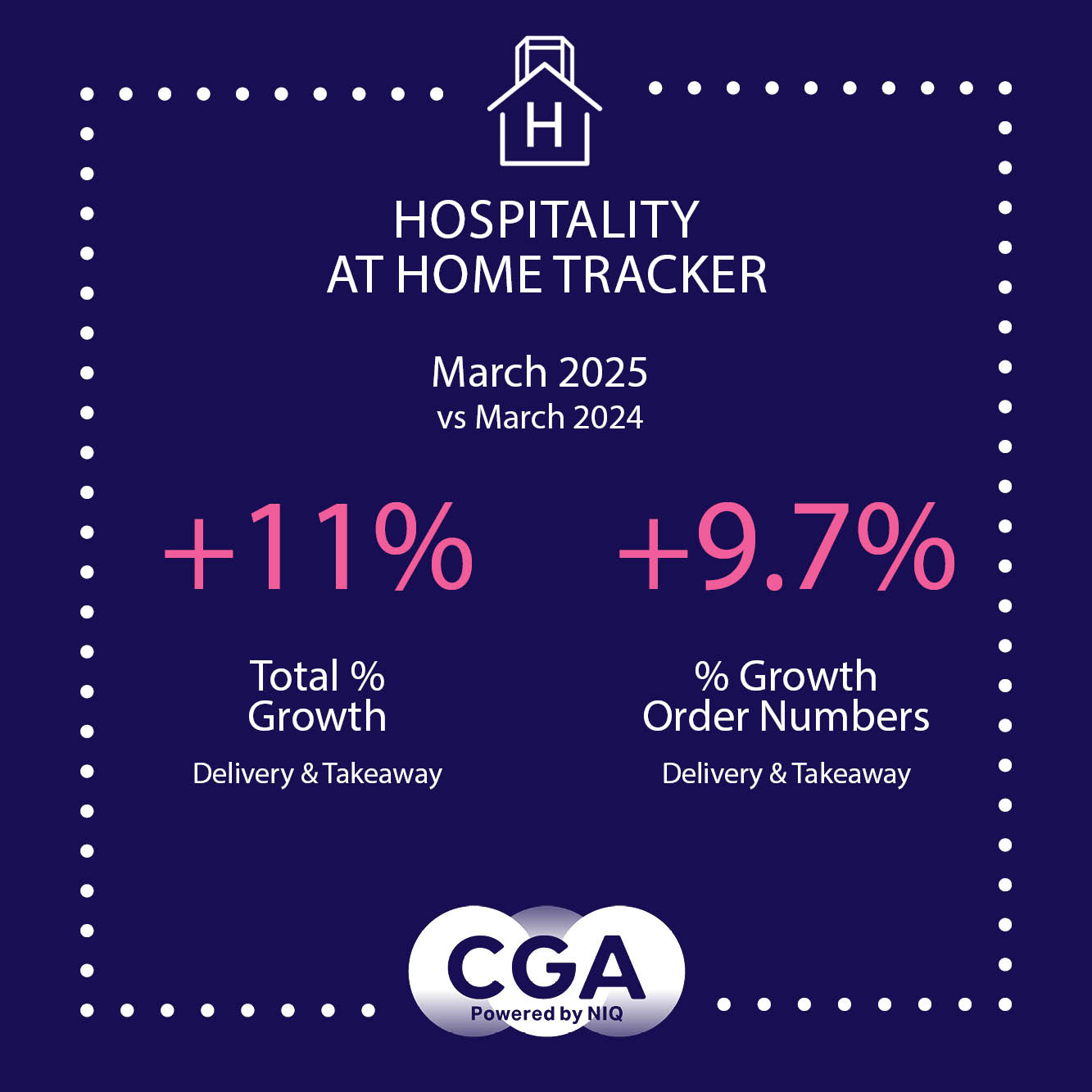

CGA’s Hospitality at Home Tracker shows stronger growth for takeaways than deliveries in March. Sales from takeaways and click-and-collect orders rose by 1.7% on a like-for-like basis, while deliveries were exactly level. Total combined sales—including from venues opened in the last 12 months—were 11.0% up on March 2024.

Karl Chessell, CGA by NIQ’s director – hospitality operators and food, EMEA said: “A flat first quarter for at-home sales is a disappointing result for restaurant operators. Coupled with ongoing pressure on operating costs, especially from the new burden of National Insurance contributions from April, it means margins will be under severe strain at some groups. After a long-term movement towards the convenience of deliveries, the better performance of takeaways lately suggests some consumers may be switching orders to avoid the premium of delivery. While underlying demand for eat-at-home orders remains good, real-terms growth will continue to be hard-earned in the second quarter.”

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Bleecker St. Burger, Byron, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, Mission Mars, Mitchells & Butlers, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, TGI Friday’s, Tortilla, Tossed, Wagamama, Wasabi, Wingstop and YO! Sushi. Anyone interested in joining the Tracker should contact Karen Bantoft here.