The comparison is the strongest of the year so far on a like-for-like basis, and a welcome boost for managed restaurant groups after a challenging 2025 for dine-in sales. The figure is exactly double the UK’s rate of inflation in October, as measured by the Consumer Prices Index.

challenging 2025 for dine-in sales. The figure is exactly double the UK’s rate of inflation in October, as measured by the Consumer Prices Index.

Growth in deliveries was in sharp contrast to takeaway and click-and-collect orders, which fell 5.1% from October 2024—one of the worst figures of the year, as consumers’ steady move away from picking up food went on.

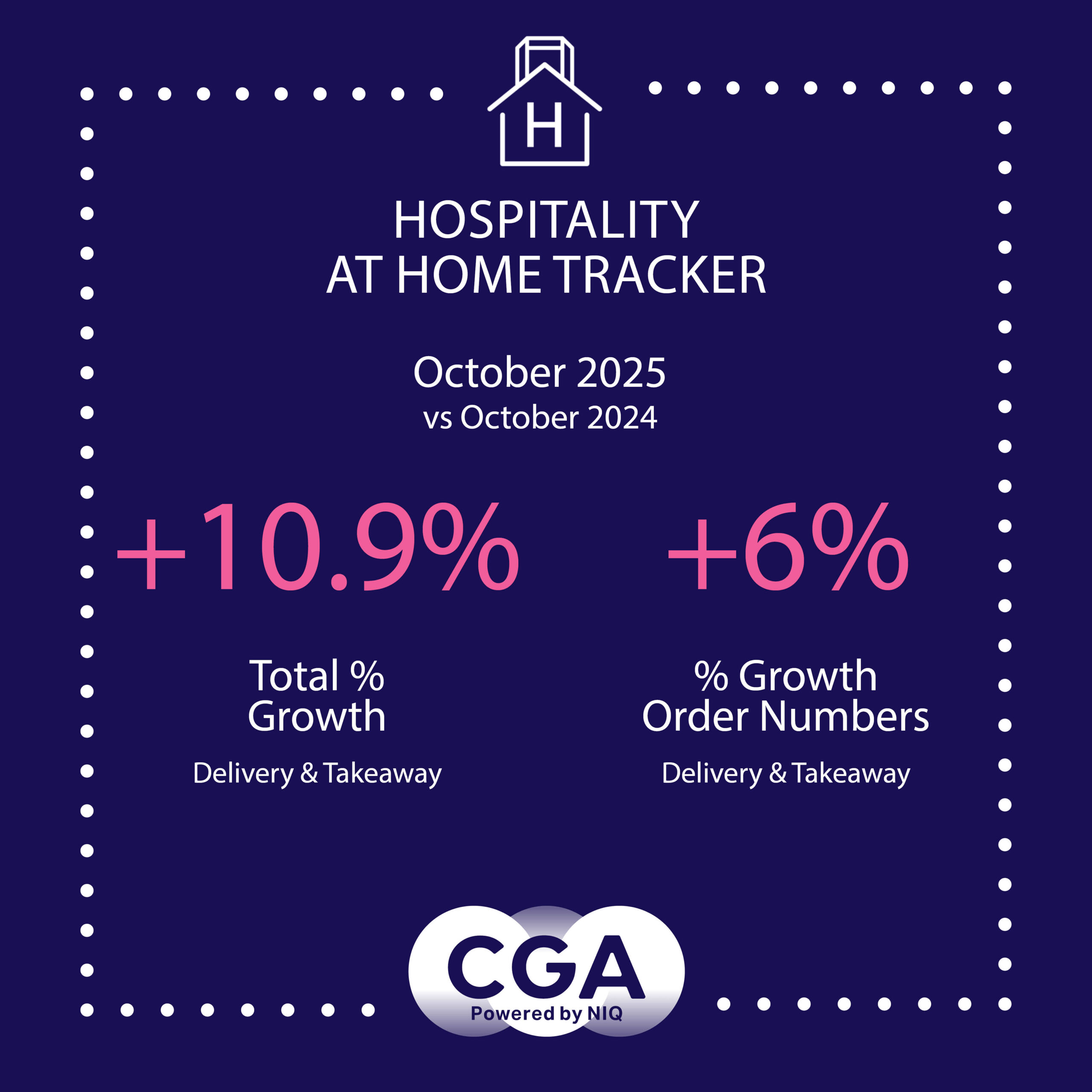

Combined, delivery and takeaway sales by value were 3.7% ahead of the same month last year. On a total basis—including from newly-opened restaurants, or where deliveries and takeaways have been introduced for the first time—sales were 10.9% ahead.

The Hospitality at Home Tracker shows deliveries attracted 13.1 pence in every pound spent with restaurants in October. This is nearly treble the value of takeaways and click-and-collect orders, which earned 4.7 pence in every pound.

Karl Chessell, director – hospitality operators and food, EMEA at CGA by NIQ, said: “The rise of third-party delivery platforms has dramatically changed the game for restaurants at-home sales. After a stalling of growth in 2025, and below-inflation increases from in-restaurant sales throughout the year, October brought a welcome boost for deliveries. However, double-digit total growth also indicates a wave of new delivery offers and intense competition in this sector. This means restaurants will have to ensure consistent high standards of food and experience to sustain growth over Christmas and beyond.”

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Bills, Bleecker St Burger, Byron, Coco Di Mama, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, HOP Vietnamese, Kricket, Megan’s, Mission Mars, Mitchell and Butlers, Mowgli, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, TGI Fridays UK, Tortilla, Tossed, Wagamama, Wasabi, Wingstop, YO! Sushi and Yolk.

Anyone interested in joining the Tracker should contact Karen Bantoft here.