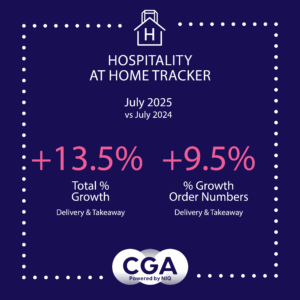

This represents a sharp uplift compared to previous months of flat or marginal growth. The boost is supported by robust delivery performance, which saw sales climb by 15.8%, alongside a 9.5% increase in combined total order numbers, indicating improved frequency and consumer confidence in the delivery market.

This represents a sharp uplift compared to previous months of flat or marginal growth. The boost is supported by robust delivery performance, which saw sales climb by 15.8%, alongside a 9.5% increase in combined total order numbers, indicating improved frequency and consumer confidence in the delivery market.

Takeaway and click-and-collect sales also improved, albeit more modestly, with an 8.4% total year-on-year monthly takeaway sales growth.

Overall, the at-home market in July reflects a return to form for delivery after a muted summer so far, due to mixed weather and ongoing uncertain consumer confidence.

Total order volume for delivery exceeded 2.95 million, with takeaway orders just shy of 2.32 million. This data demonstrates a healthy appetite across both formats, but a noticeable preference for delivery-led convenience, as operators tap into sporting and cultural events and summer’s feel-good factor, bringing the party to consumers who choose to stay at home to celebrate and socialise.

Karl Chessell, director – hospitality operators and food, EMEA at CGA by NIQ, said: “July’s delivery-led growth is welcome news. The opportunity now is to build on delivery’s strong channel momentum, with value, consistency, and experience-led innovation. The right partnership marketing, promotional alignment, digital engagement and fulfilment capabilities are key for optimising this growth potential, even as broader consumer confidence wavers.”

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Bills, Bleecker St Burger, Byron, Coco Di Mama, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, HOP Vietnamese, Megan’s, Mission Mars, Mitchell & Butlers, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, TGI Fridays UK, Tortilla, Tossed, Wagamama, Wasabi, Wingstop, YO! Sushi and Yolk.

Anyone interested in joining the Tracker should contact Karen Bantoft here.