Revenue was marginally down by 0.3% on a like-for-like basis across the month—a downward movement after 1.8% growth in May. It completes a muted first half of 2025 for restaurants, with at-home sales less than 2 percentage points either side of level in all six months.

Restaurants’ trends in deliveries and takeaways mirror those of in eat-in sales. The CGA RSM Hospitality Business Tracker—based on a separate cohort of restaurant operators—showed like-for-like June sales were exactly level with the same month in 2024. Trading in both channels in the latest month was impacted by mixed weather and hesitant consumer confidence.

The Hospitality at Home Tracker shows deliveries slightly outperformed the at-home market as a whole in June, with growth of 1.6% compared to a drop of 4.6% in takeaways and click-and-collect sales. However, the volume of orders rose in both channels—by 6.6% in deliveries and 11.2% in takeaways.

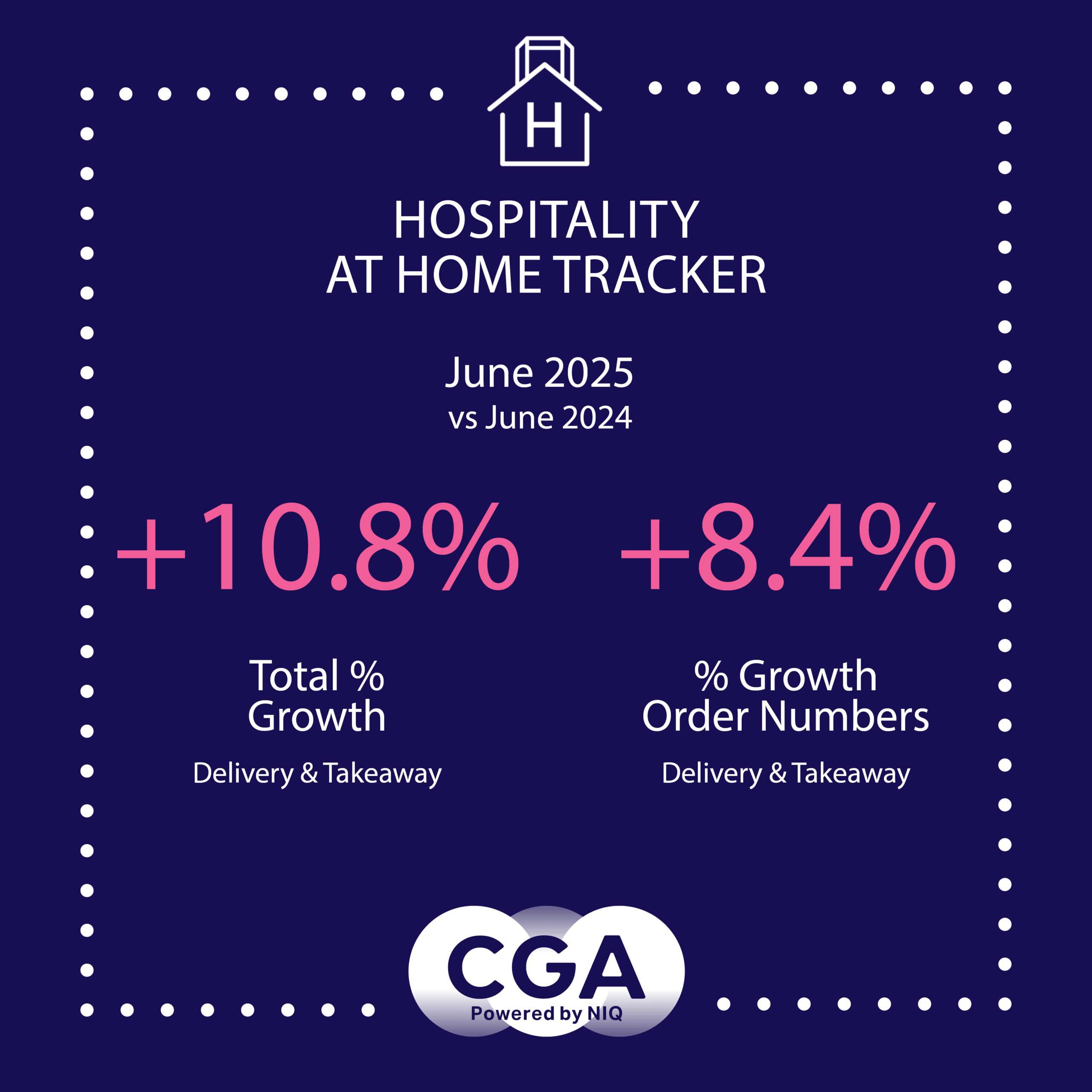

The Tracker reveals that deliveries and takeaways accounted for 18.3 pence in every pound spent with participating restaurants in June. Total combined sales—including from venues opened by groups in the last 12 months, or where deliveries and takeaways were introduced for the first time—were 10.8% higher than in June 2024.

Karl Chessell, CGA by NIQ’s director – hospitality operators and food, EMEA said: “A flat June rounds out a challenging first half of 2025 for restaurants, across both at-home and eat-in operations. Sustained, real-terms growth has been elusive, and any increases have mostly been driven by higher menu prices and new openings. Alongside soft spending, the impact of increased labour costs is now being keenly felt across hospitality, and while the sector’s long-term outlook remains positive, margins are likely to remain under severe pressure over the second half of 2025.”

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Bills, Bleecker St Burger, Byron, Coco Di Mama, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, HOP Vietnamese, Megan’s, Mission Mars, Mitchell & Butlers, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, TGI Fridays UK, Tortilla, Tossed, Wagamama, Wasabi, Wingstop, YO! Sushi and Yolk. Anyone interested in joining the Tracker should contact Karen Bantoft here.