January delivery sales at Britain’s leading restaurant groups were down by 1.0% from the same month in 2024. It is the Tracker’s first negative number since June 2023, and well short of the UK’s general monthly rate of inflation of 3.0%, as measured by the Consumer Price Index.

By contrast, the Tracker shows modest growth of 2.1% in revenue from takeaway and click-and-collect orders. These sales have now been in year-on-year growth for six months in a row—a turnaround from 11 consecutive months of decline.

January’s delivery trends are in line with wider seasonal spending patterns. The latest CGA RSM Hospitality Business Tracker—based on a separate cohort of managed groups—recorded a 1.3% fall in sales year-on-year. This was an abrupt reversal of 3.2% growth in December, when consumers headed out to restaurants, pubs and bars to celebrate Christmas rather than ordering in.

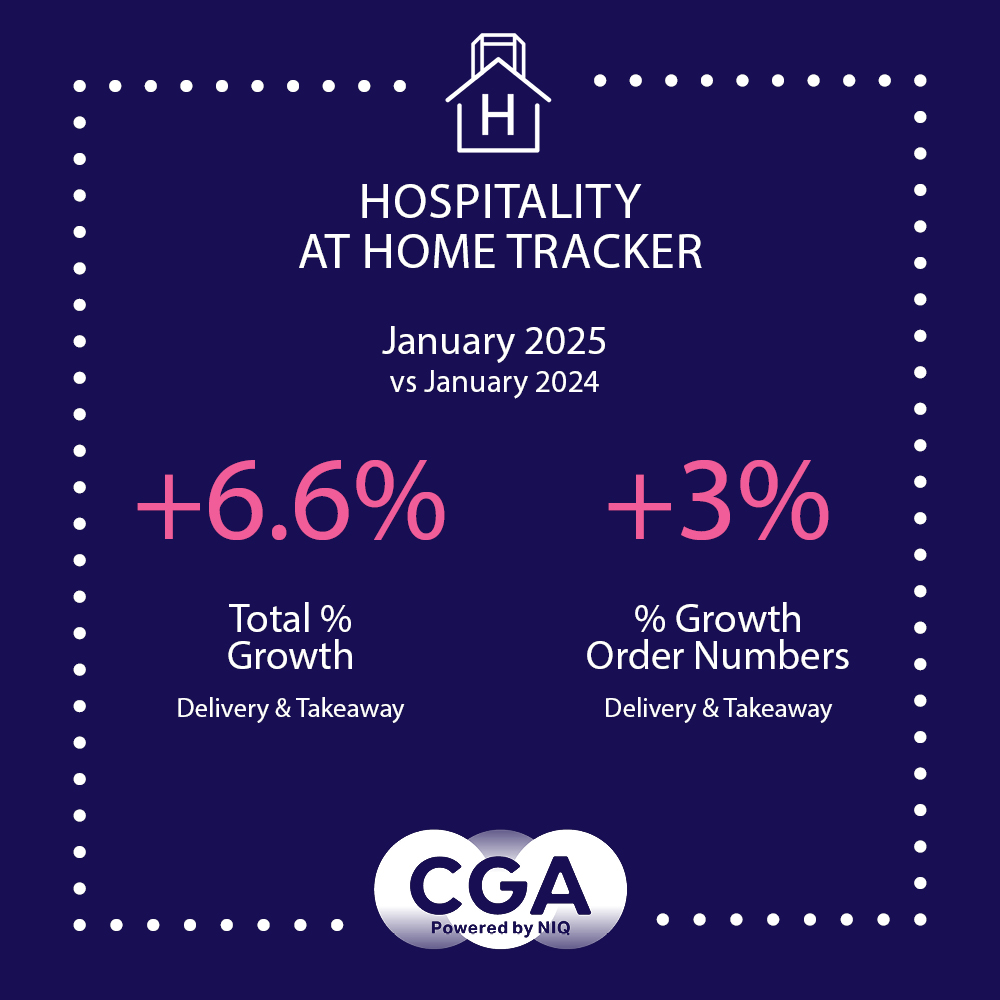

CGA’s Hospitality at Home Tracker shows that combined delivery and takeaway sales were 0.6% behind January 2024. Total sales—including from new sites opened in the last 12 months—rose 6.6%.

Karl Chessell, CGA by NIQ’s director – hospitality operators and food, EMEA said: “After some consumers splurged on meals and drinks out over Christmas, it is little surprise to see a levelling-off in January. Nevertheless, it is a disappointing start to what will be another challenging year for restaurants, especially with key costs like labour and energy set to rise. More positively, the premium paid for the convenience of deliveries may now be tilting people towards takeaways and click and collect orders. With so many consumers still feeling the pinch on disposable incomes, we can expect to see this trend continue through 2025.”

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Byron, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, Mission Mars, Mitchells & Butlers, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, TGI Fridays UK, Tortilla, Wagamama, Wasabi and YO! Sushi. Anyone interested in joining the Tracker should contact Karen Bantoft here.