It is the Tracker’s second negative number of 2025 and the fifth consecutive month of below-inflation growth. Trading was subdued by good weather and the long Easter weekend, which led some consumers to drink out rather than ordering food for delivery or takeaway. Other outdoor activities and home barbecues may also have eaten into consumers’ spending.

the long Easter weekend, which led some consumers to drink out rather than ordering food for delivery or takeaway. Other outdoor activities and home barbecues may also have eaten into consumers’ spending.

The marginal decline is in line with the separate CGA RSM Hospitality Business Tracker, which recorded a year-on-year drop of 0.9% in managed restaurant groups’ total sales in April, but 9.1% growth for pubs.

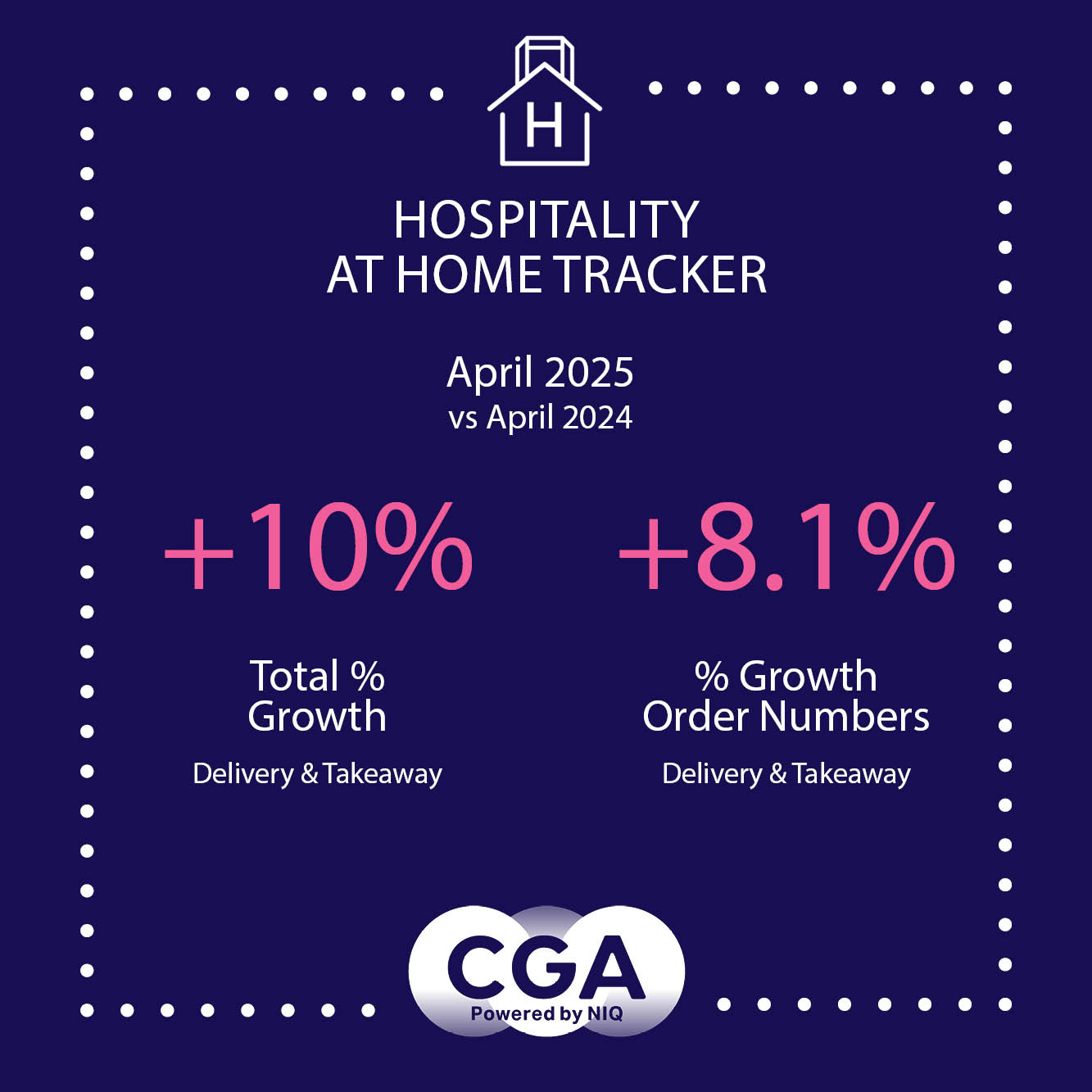

CGA’s Hospitality at Home Tracker shows slightly better trading for deliveries than takeaways in April. Delivery revenue was exactly level year-on-year, while sales from takeaways and click-and-collect orders fell 1.9% on a like-for-like basis. Total combined sales were 10.0% ahead of April 2024, reflecting a sharp increase in venues providing deliveries and takeaways in the last 12 months.

Karl Chessell, CGA by NIQ’s director – hospitality operators and food, EMEA said: “Warm weather is usually better news for pubs than restaurants, and it’s clear that drinking-out was the priority in April. Disposable incomes remain limited for many consumers, and with various other options for their money, a softening in delivery and takeaway sales isn’t surprising. While sales have now been flat or below inflation for five months, it’s important to note that this follows a period of significant growth in the channel. Operators will be hoping that momentum returns over the summer as habits settle and demand picks up again.”

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Byron, Coco di Mama, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, HOP Vietnamese, Megan’s, Mission Mars, Mitchells & Butlers, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, Tossed, TGI Fridays UK, Tortilla, Wagamama, Wasabi, Wingstop and YO! Sushi. Anyone interested in joining the Tracker should contact Karen Bantoft here.