Operators and suppliers enjoyed a bright Spring, with sales running ahead of last year’s level for ten out of 11 weeks between February and late April, and the beer and cider categories flourishing. However, that good run came to a halt in the seven days to 10 May, when sales finished 8% behind the equivalent period in 2024.

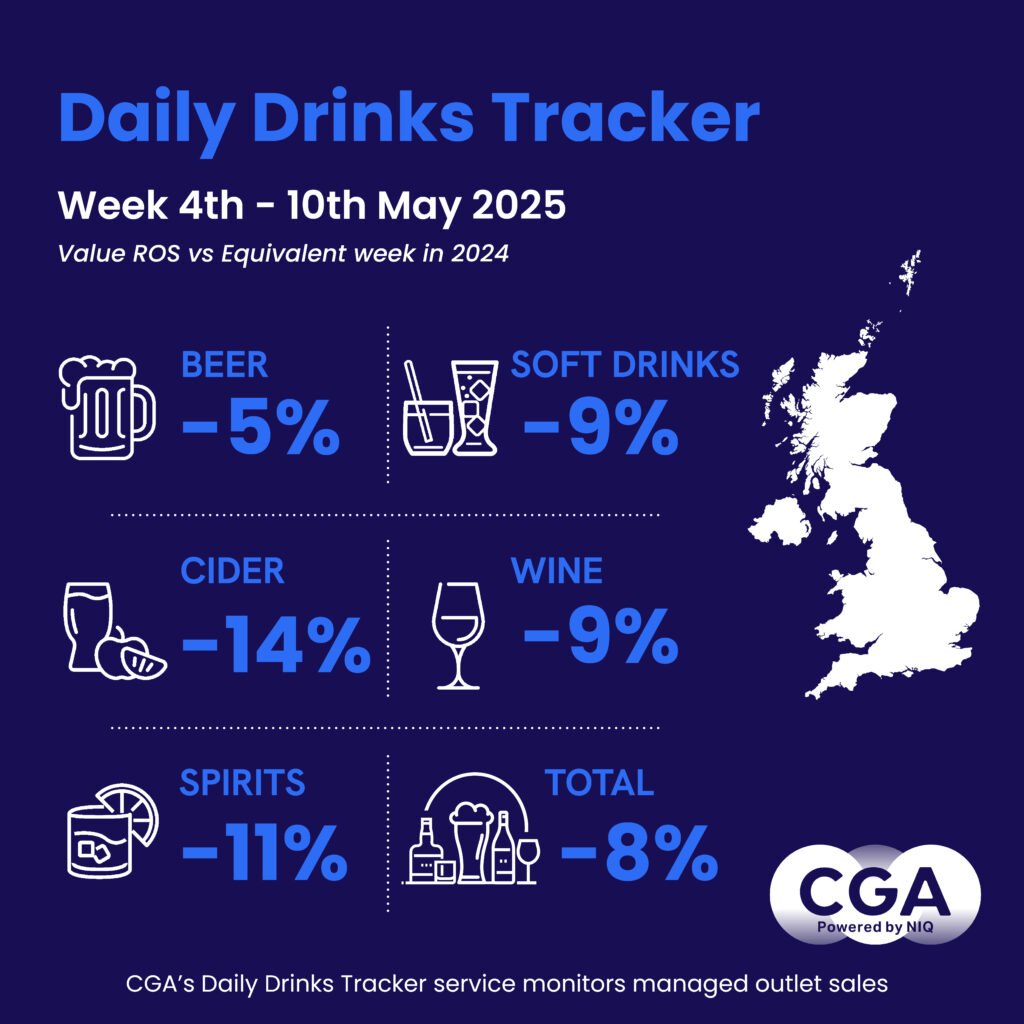

Operators and suppliers enjoyed a bright Spring, with sales running ahead of last year’s level for ten out of 11 weeks between February and late April, and the beer and cider categories flourishing. However, that good run came to a halt in the seven days to 10 May, when sales finished 8% behind the equivalent period in 2024.

Damp weather across much of Britain kept drinks sales down throughout the week, negating the benefits of a long Bank Holiday weekend. Better weather in 2024 also made for tough comparisons. All major drinks categories were behind, with cider (down 14%), spirits (down 11%) and wine (down 9%) the worst hit. Beer (down 5%) was slightly brighter thanks to brief breaks in the weather.

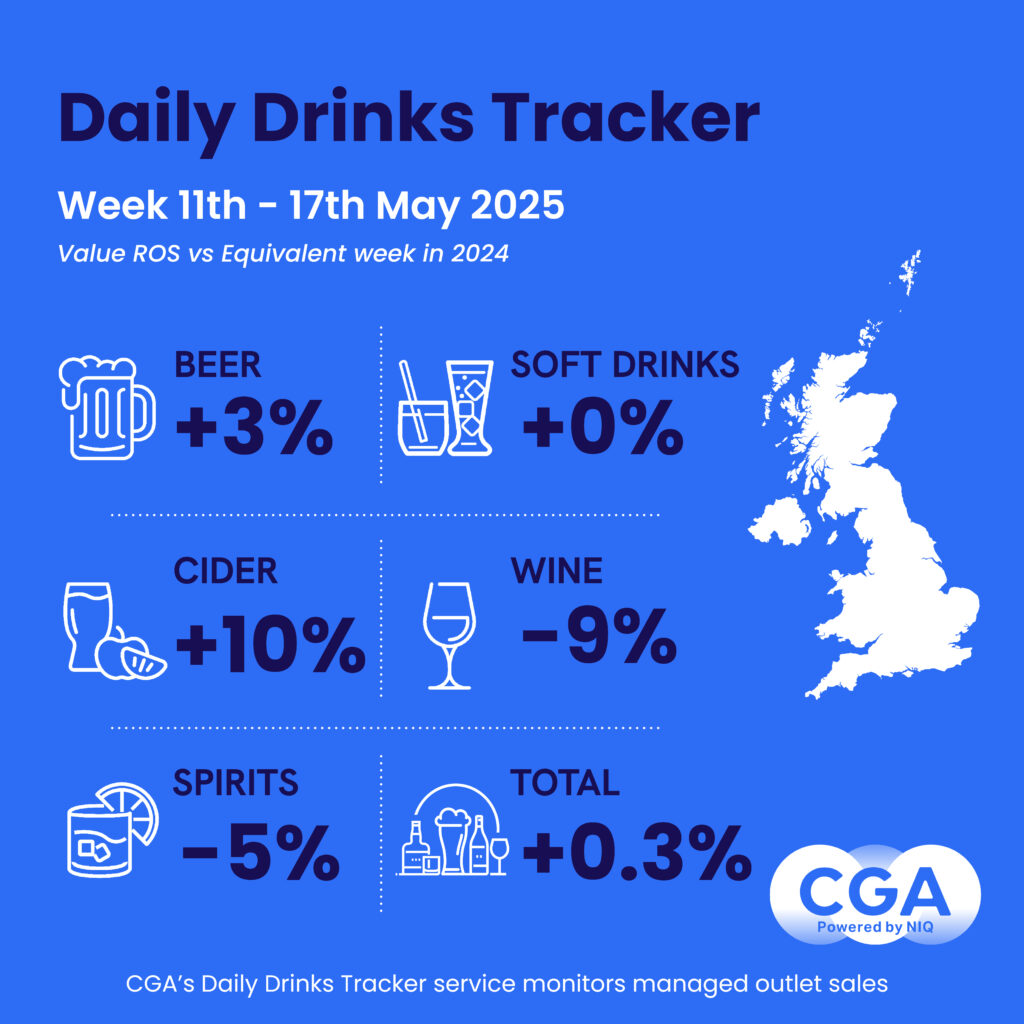

The Daily Drinks Tracker shows the following week, to 17 May, was a little better for the On Premise, with marginal year-on-year growth in drinks sales of 0.3%. Trading jumped by 10% and 15% on Monday 12 and Tuesday 13 May and was largely flat on other days. Cider finished a rollercoaster fortnight with 10% growth, but spirits (down 5%) and wine (down 9%) had another challenging week.

Rachel Weller, CGA by NIQ’s commercial lead, UK & Ireland, said: “Spring and Summer drinks sales are always tied closely to the weather, and after a warn April, May sales have dropped in line with the temperatures. The dip in early May also suggests that consumers’ confidence remains limited, and that some disposable incomes were used up during the sunshine. Nevertheless, the wider picture shows pubs have been on a good run, and suppliers can be optimistic for the key Summer months—as long as the weather plays its part.”

The Daily Drinks Tracker provides analysis of sales at managed licensed premises across Britain and is part of CGA by NIQ’s suite of research services delivering in-depth data on category, supplier and brand rate of sale performance. To learn more, click here and contact the CGA by NIQ team.

This press release includes forward-looking statements that reflect NielsenIQ’s (NIQ) current expectations and projections about future market trends and consumer behavior. These statements are based on available information and reasonable assumptions but are subject to risks and uncertainties that could cause actual results to differ. NIQ does not undertake to update these statements, except as required by law.

Rachel Weller, CGA by NIQ’s commercial lead, UK & Ireland, said: “Spring and Summer drinks sales are always tied closely to the weather, and after a warn April, May sales have dropped in line with the temperatures. The dip in early May also suggests that consumers’ confidence remains limited, and that some disposable incomes were used up during the sunshine. Nevertheless, the wider picture shows

Rachel Weller, CGA by NIQ’s commercial lead, UK & Ireland, said: “Spring and Summer drinks sales are always tied closely to the weather, and after a warn April, May sales have dropped in line with the temperatures. The dip in early May also suggests that consumers’ confidence remains limited, and that some disposable incomes were used up during the sunshine. Nevertheless, the wider picture shows