Like-for-like sales were up by only 1.7% from February 2024—below the country’s current rate of inflation as measured by the Consumer Prices Index. It follows a 0.6% drop in January, which was the Tracker’s first negative number for more than 12 months.

The flattening of restaurants’ at-home sales is in line with eat-in trends measured by the separate CGA RSM Hospitality Business Tracker. This Tracker—based on a different cohort of managed groups—recorded a year-on-year sales increase of just 0.1% in February.

Weak growth reflects a squeeze on many consumers’ spending in light of rising household costs, as well as uncertainty about the economic outlook. CGA’s exclusive Consumer Pulse research in February showed well over half of Britons remain either severely (18%) or moderately (39%) impacted by the cost of living crisis, and 42% said they were going out to eat and drink less frequently—more than double the 18% who were going out more often.

A breakdown of CGA’s Hospitality at Home Tracker indicates deliveries provided slightly stronger sales growth in February 2025, rising 2.4% year-on-year. Takeaways and click-and-collect orders increased by just 0.4%—their lowest figure since August.

Karl Chessell, CGA by NIQ’s director – hospitality operators and food, EMEA said: “The flatlining of both eat-in and at-home sales has made it a concerning start to 2025 for many hospitality groups. Rising costs continue to compromise consumers’ discretionary spending and they are also intensifying the pressure on restaurants’ menu prices and profit margins. Forthcoming increases to employers’ National Insurance contributions will further weaken some vulnerable businesses, and more support is urgently needed to sustain this vital sector. Better weather will hopefully encourage more people to go out in the next few months but the outlook for 2025 remains challenging.”

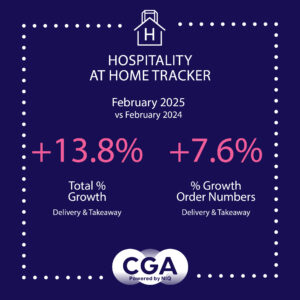

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Bleecker St. Burger, Byron, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, Mission Mars, Mitchells & Butlers, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, TGI Friday’s, Tortilla, Tossed, Wagamama, Wasabi, Wingstop and YO! Sushi. Anyone interested in joining the Tracker should contact Karen Bantoft here.