Canadian Whisky and American Whiskey make up two thirds of all Whiskey volume sold in bars and restaurants, making the dynamic between both extremely crucial to the categories overall performance. Both have been experiencing slight declines in volume sales, with OPM (On Premise Measurement) data showing a -2.7% year-on-year decline in all whisky volumes sold in bars and restaurants in Canada, up to November 2024. However, whisky isn’t the only spirit in decline, this is the case for all categories across Canada, except for Tequila, which is the only category in growth.

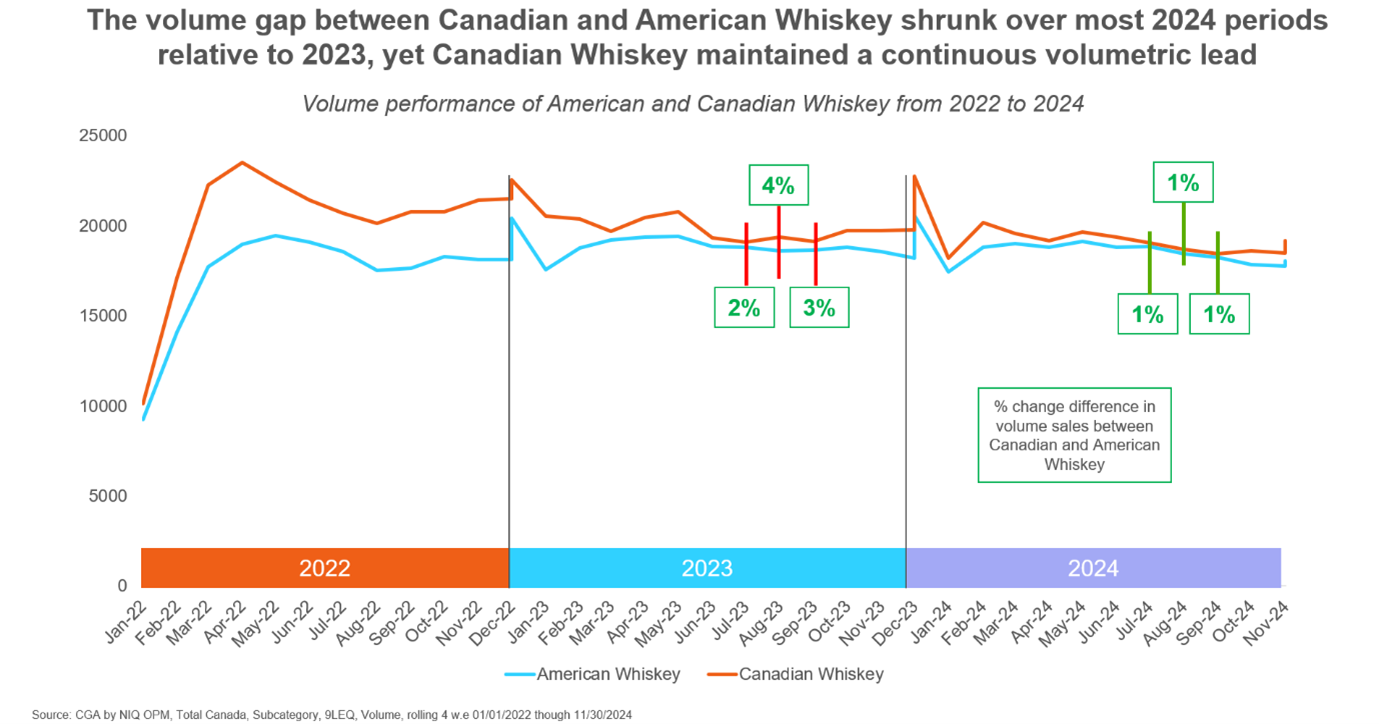

However, whisky remains the second biggest spirit by volume, and whilst Canadian whisky is still the largest in size by volume sold out of bars and restaurants nationally, its sales volumes have shrunk at more than double (-3.6%) the rate of American whiskey (-1.4%) over the last year.

American whiskey has been gaining market share in bars and restaurants. However, the latest Canada On Premise Consumer Pulse report shows that for over 1 in 3 consumers, it’s increasingly important that their drink is made by a Canadian brand compared to a year ago. This growing preference for local products could impact the category moving forward.

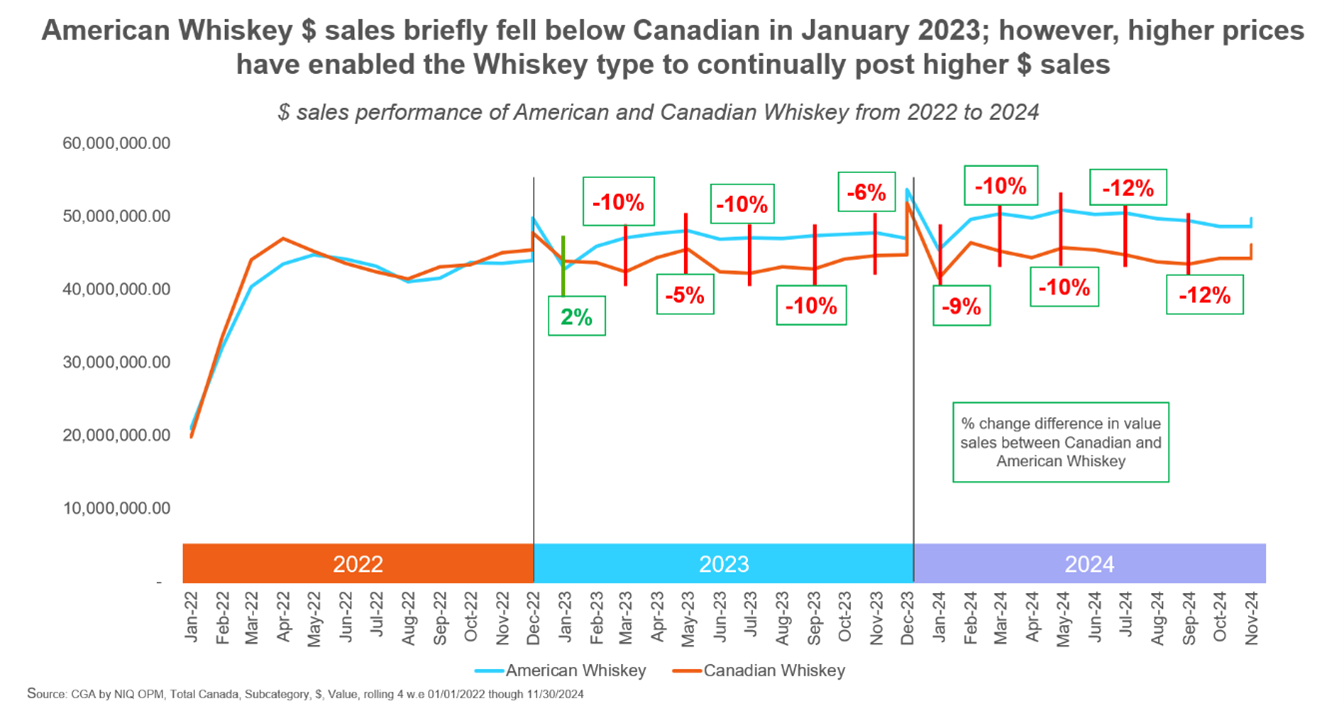

Although Canadian Whisky still leads American Whiskey in terms of volume, American Whiskey nets nearly 10% more dollar sales. Over the past two years, the gap in total dollar sales has slightly widened in favor of American Whiskey. This is largely due to the higher price points and the wide range of premium products available to consumers.

As uncertainty grows in Canada and the US, staying informed (and agile) is key as new policy frameworks take shape in the months to come. CGA by NIQ offers essential On Premise Measurement for spirits and beer in both the Canadian and US markets, delivering up-to-date analysis of purchasing and distribution trends. Reach out to our expert team here for more information, or you can find out more in NIQ’s Time for Tariffs Report.