Rachel Weller, Commercial Leader UK & IRE at CGA by NIQ, draws on volumetric results from last year’s Christmas season, along with insights into consumer behaviour and drink choices, to identify opportunities for brands, suppliers, and operators to achieve growth in the On Premise this festive season.

The weeks before Christmas and New Year are vital for the On Premise sector as they tend to generate some of the highest revenue of the year. To help bars, pubs, restaurants, and their suppliers make the most of this key period, we have reviewed data from last year’s festive season to guide better decision-making and maximise potential. The data presented here is drawn from a combination of CGA by NIQ’s consumer and sales research tools, including our Business Tracker, BrandTrack, EPOS, OPM, and the latest Christmas report. By leveraging such an extensive range of insights, we can offer an in-depth exploration of how consumers engage with the On Premise during this critical time, examining Christmas behaviour to uncover patterns in habits, spending, preferences, and purchase drivers.

![]() Data from over 60,000 outlets during the last Christmas season, for instance, shows that pubs were the main drivers of topline sales growth. Managed operators overall saw an 8.8% increase in sales compared to the previous year, but wet-led pubs outpaced this with nearly 10% growth, while food-led pubs followed at 9.3%. In contrast, restaurants and bars underperformed, growing by 8.3% and just 5.6%, respectively, as ongoing financial pressures continued to weigh on food-led and late-night venues.

Data from over 60,000 outlets during the last Christmas season, for instance, shows that pubs were the main drivers of topline sales growth. Managed operators overall saw an 8.8% increase in sales compared to the previous year, but wet-led pubs outpaced this with nearly 10% growth, while food-led pubs followed at 9.3%. In contrast, restaurants and bars underperformed, growing by 8.3% and just 5.6%, respectively, as ongoing financial pressures continued to weigh on food-led and late-night venues.

In December 2023, consumers were less affected by rail strikes compared to the previous year, which led to notable year-on-year sales growth in mid-December, particularly in the weeks from just before ‘Mad Friday’ through to the end of the year. This figure serves as a clear reminder that businesses must remain mindful of external factors that can significantly impact trade, and wherever possible, they should try to anticipate and mitigate such challenges.

During this period, weekends are consistently – and perhaps expectedly – the most popular times for consumers to visit bars, pubs, and restaurants. Last year, the 16th of December was the most profitable day. This is likely because Mad Friday fell on the 22nd, just before Christmas Eve and Christmas Day, prompting many workplaces and social events to move earlier to avoid clashing with family commitments and travel plans. This year, Mad Friday falls slightly earlier (20th of December), yet still close enough to Christmas, so businesses should once again expect high activity the preceding weekend.

Fewer, younger, wealthier

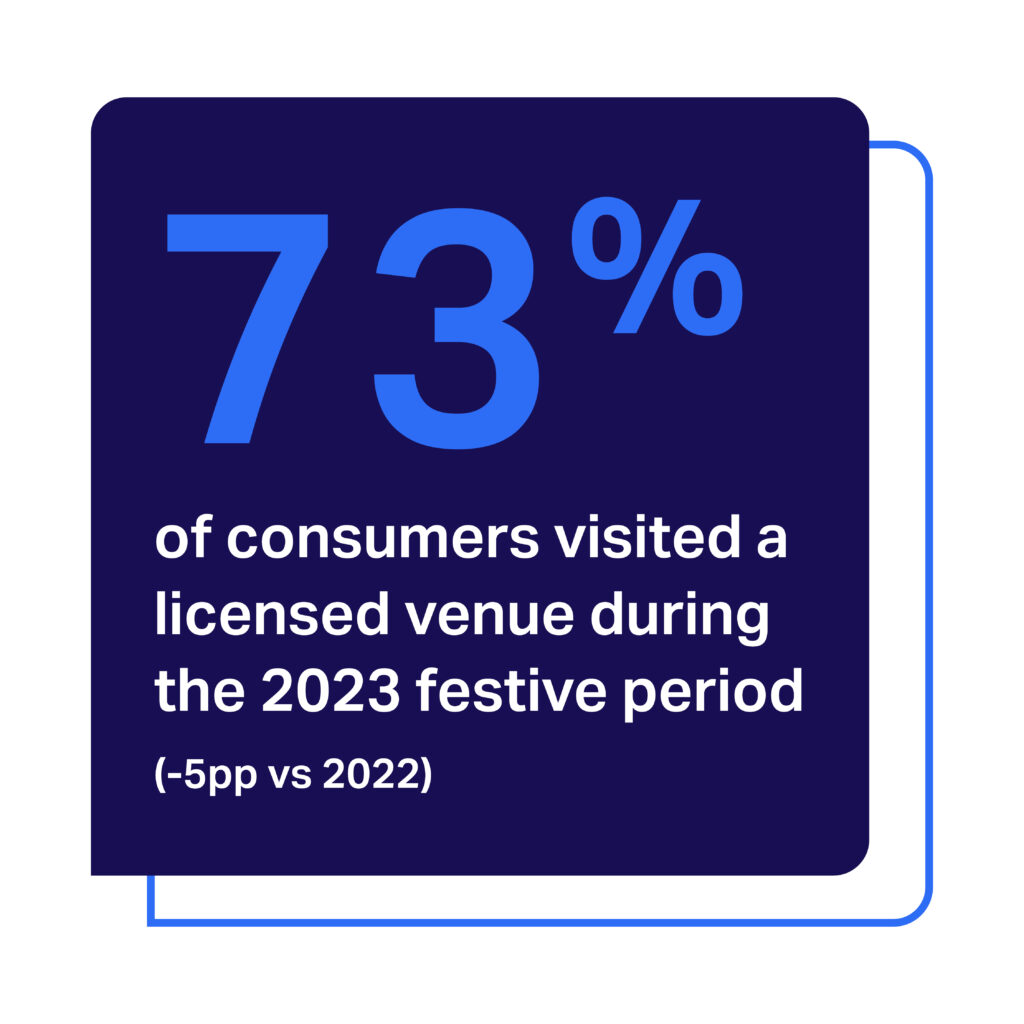

Consumer visits saw a slight decline last year, with 73% of consumers visiting a licensed venue during the 2023 festive period, down 5 percentage points (pp) from 2022. Yet, more consumers ventured out during the week leading up to Christmas. Again, this uptick is likely due to Mad Friday falling late in the season, just before Christmas.

But who exactly did go out during the festive period? Our research reveals that those who visited the On Premise were generally younger and had higher average incomes. This may explain why, despite a slight drop in overall footfall, these consumers maintained their 2022 levels of spending when dining or drinking out.

Meanwhile, most of those who did not go out were people who typically avoid the festive season rush and are unlikely to change this habit. That being said, for many, the decision not to go out wasn’t purely personal: financial constraints played a significant role, too. For 27%, it was simply too expensive, while over one in five had less disposable income or chose to prioritise their spending elsewhere. Remarkably, a dramatic 19% said they were concerned about their financial situation and stayed home to save money – displaying promotions or ensuring good value in a venue’s offering could help attract more footfall this year, especially from those feeling the pinch.

In fact, businesses should recognise that while these reasons contributed to people staying home, the cost of living crisis clearly affects those who do visit the On Premise, too, with a staggering 97% of all consumers reporting being impacted in some way by it. This means that even those who choose to go out may be more budget-conscious and influenced by financial considerations, so offering value and addressing these concerns to enhance customer experience is now more crucial than ever.

While businesses should certainly consider these financial concerns, our research provides some reassurance: for many consumers, the desire to experience hospitality during the festive period outweighs their financial worries. Visiting the On Premise for special occasions ranks as the third priority for spending during the festive season, even amid cost-of-living pressures. Moreover, one in five consumers affirmatively prioritise regular visits to pubs, bars, and restaurants beyond just special occasions, indicating a sustained interest in dining and drinking out despite financial challenges.

Imbibing choices

Another critical aspect that brands, suppliers, and operators need to examine closely when developing their festive season strategy is the specific drinks consumers prefer and expect to find when visiting a venue. Understanding these preferences can help businesses tailor their offerings to meet customer demands and enhance the overall experience.

Christmas is often anecdotally associated with rich and indulgent drinks, so it may come as a surprise that, in fact, soft drinks are the drink of choice during the festive season. Last year, their consumption increased by 3pp, with 30% of people opting for them. Lager ranked as the second most popular drink at 25%, though it experienced a notable decline of 3pp compared to the previous year. In contrast, consumption of cocktails and white wine, the third and fourth most popular categories respectively, remained stable, indicating that these options should also be a priority for businesses this festive season. Meanwhile, red wine, vodka, and flavoured gin all saw a decline in popularity compared to the previous year – and may well continue to do so, as our data indicates that consumers are increasingly avoiding expensive cocktails, wines, and spirits due to the cost of living crisis. In contrast, the consumption of soft drinks and no- or low-alcohol options is on the rise, as they present more affordable choices, so businesses might be able to capitalise on the festive season by focusing on these cost-effective beverage options.

Christmas is often anecdotally associated with rich and indulgent drinks, so it may come as a surprise that, in fact, soft drinks are the drink of choice during the festive season. Last year, their consumption increased by 3pp, with 30% of people opting for them. Lager ranked as the second most popular drink at 25%, though it experienced a notable decline of 3pp compared to the previous year. In contrast, consumption of cocktails and white wine, the third and fourth most popular categories respectively, remained stable, indicating that these options should also be a priority for businesses this festive season. Meanwhile, red wine, vodka, and flavoured gin all saw a decline in popularity compared to the previous year – and may well continue to do so, as our data indicates that consumers are increasingly avoiding expensive cocktails, wines, and spirits due to the cost of living crisis. In contrast, the consumption of soft drinks and no- or low-alcohol options is on the rise, as they present more affordable choices, so businesses might be able to capitalise on the festive season by focusing on these cost-effective beverage options.

Indeed, money pressures are still being felt by many consumers, with more than two out of three people now closely monitoring their spending. This has led to divergent consumer behaviours: 22% are opting for cheaper drink options. Our 2023 Christmas report reveals that consumers have varying motivations for adopting such an approach. For some, this strategy enables them to go out more frequently while staying within their budget, while others prefer to save money in order to afford more drinks during their outings.

However, the majority of consumers (39%) are controlling their spending by simply ordering fewer drinks. This means operators must ensure that each of these drinking experiences is exceptional across all aspects to drive sales and encourage repeat visits.

For some consumers, the fewer drinks they order may include special treats, as 45% of On Premise users crave these indulgences during the festive season: businesses should pay close attention to how such treat choices influence consumer behaviour, as they present significant revenue potential. The role of bar staff is essential in this regard, with one in four customers trusting their recommendations. Furthermore, 22% of drinkers are heavily swayed by what their friends are imbibing on, which underscores the strong influence of peer recommendations on drink selections.

While some factors influencing consumer choices may be somewhat beyond businesses’ control, there are other elements that operators, brands, and suppliers can manage to positively impact consumer behaviour. Nearly one in five consumers choose their drinks based on meal and drink deals, while 17% are influenced by the visibility of drinks displayed behind the bar, and 16% are swayed by pairing suggestions found on the menu. This indicates that operators and brands can collaborate to capture market share and maximise sales with high-margin products by implementing effective activations and promotions and ensuring these products are prominently showcased to consumers.

As our data demonstrates, the festive season – from the week leading up to Mad Friday through the end of the year – is a crucial time for both On Premise venues and for partnering suppliers and brands. It is a period that often generates a significant portion of annual revenue, compensating for slower times throughout the year. Therefore, it is vital for all businesses to leverage data to inform their strategies and collaborate effectively to capture market share and maximise sales during this challenging yet joyful time of the year.

Click here for exclusive consumer insights from CGA by NIQ’s Christmas Report 2024. The Report delivers comprehensive and best-in-class insights into consumers’ habits over Christmas and New Year, helping On Premise suppliers and operators optimise festive sales and marketing strategies. Solutions including On Premise Measurement (OPM) and On Premise User Survey (OPUS) provide even deeper knowledge of Christmas occasions, channels and categories.

Click here for exclusive consumer insights from CGA by NIQ’s Christmas Report 2024. The Report delivers comprehensive and best-in-class insights into consumers’ habits over Christmas and New Year, helping On Premise suppliers and operators optimise festive sales and marketing strategies. Solutions including On Premise Measurement (OPM) and On Premise User Survey (OPUS) provide even deeper knowledge of Christmas occasions, channels and categories.

To discover more and discuss opportunities for expert bespoke analysis contact the CGA team.

Originally published in Global Drinks Intel Magazine