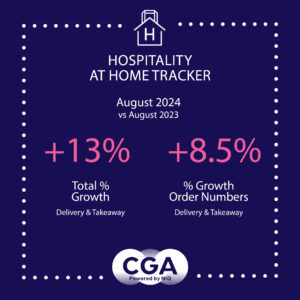

Year-on-year increases in deliveries have been comfortably above the rate of inflation throughout 2024, falling below 7% only once since the start of the year. August completes a buoyant summer for restaurants’ at-home orders, following the Tracker’s figures of 17.1% and 9.4% in June and July respectively.

Year-on-year increases in deliveries have been comfortably above the rate of inflation throughout 2024, falling below 7% only once since the start of the year. August completes a buoyant summer for restaurants’ at-home orders, following the Tracker’s figures of 17.1% and 9.4% in June and July respectively.

CGA’s exclusive monitor of sales also reveals a 0.1% rise in takeaway and click-and-collect sales in August. This is the first year-on-year growth for 12 months, following consumers’ steady movement away from pick-up orders to deliveries. However, the positive performance was driven by increased prices, as the volume of takeaway orders continued a downward trajectory.

Combined deliveries, takeaways and click-and-collect sales in August were 4.6% ahead of the same month in 2023—the 15th month of like-for-like growth in a row. They attracted just over 14 pence in every pound spent with restaurants last month, against 86 pence for eat-in visits.

Karl Chessell, CGA by NIQ’s director – hospitality operators and food, EMEA said: “A generally cool and wet summer has been disappointing for consumers and hospitality alike, but with many people staying inside it’s worked to the advantage of restaurants’ deliveries. A buoyant August shows the ongoing appeal of and ordering platforms, and it’s encouraging to see some stability in takeaways after a long-term slowdown. Less positively, it may also indicate that some consumers are opting to save money by eating restaurant food at home rather than going out. Growing eat-in sales without compromising deliveries will be a key challenge for restaurants as we enter autumn.”

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Byron, Chopstix, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, Mitchells & Butlers, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, TGI Fridays UK, Tortilla, Wagamama, Wasabi and YO! Sushi. Anyone interested in joining the Tracker should contact Karen Bantoft here.